With the power of the internet, modern businesses have the ability to expand their reach around the world without ever opening a satellite office.

That fact has been crucial in the recent deliberations regarding Netflix’s presence in Canada, though the company’s lack of a local office has exempted Canadians from paying a GST sales tax on their monthly subscription fee.

Internet businesses have created a new threshold for international commerce. Up until this point in Canada, there has been no talk of developing legislation for taxing an internet service that, in simplest terms, has no Canadian mailbox.

Media outlets have begun using the phrase “Netflix Tax” as shorthand for the discussions about this issue taking place at the federal level.

However, as the term has become more popular, many began to use it to refer to the arguments surrounding Netflix’s business model, including the claim that Netflix’s presence in Canada requires the company to contribute to the development of Canadian culture.

The name was also used in reference to the potential fee paid by Canadian users of other similar companies such as Spotify and Amazon Prime Video, which has come to be known as an “Internet Tax.”

MobileSyrup reached out to several experts to clarify the different debates around the phrase “Netflix Tax,” and the precedent that these discussions may set for digital legislation in the future.

Definition #1: A sales tax on digital services

The Netflix Tax is most simply used to describe a potential solution to a legislative loophole that allows Canadian users of Netflix to avoid paying taxes on their subscription fees.

Federal representatives have realized over the past few years that there is no legal requirement for Netflix to collect such GST sales taxes from Canadian customers. This is because the law in its current state doesn’t equate the company’s digital presence to that of a physical one.

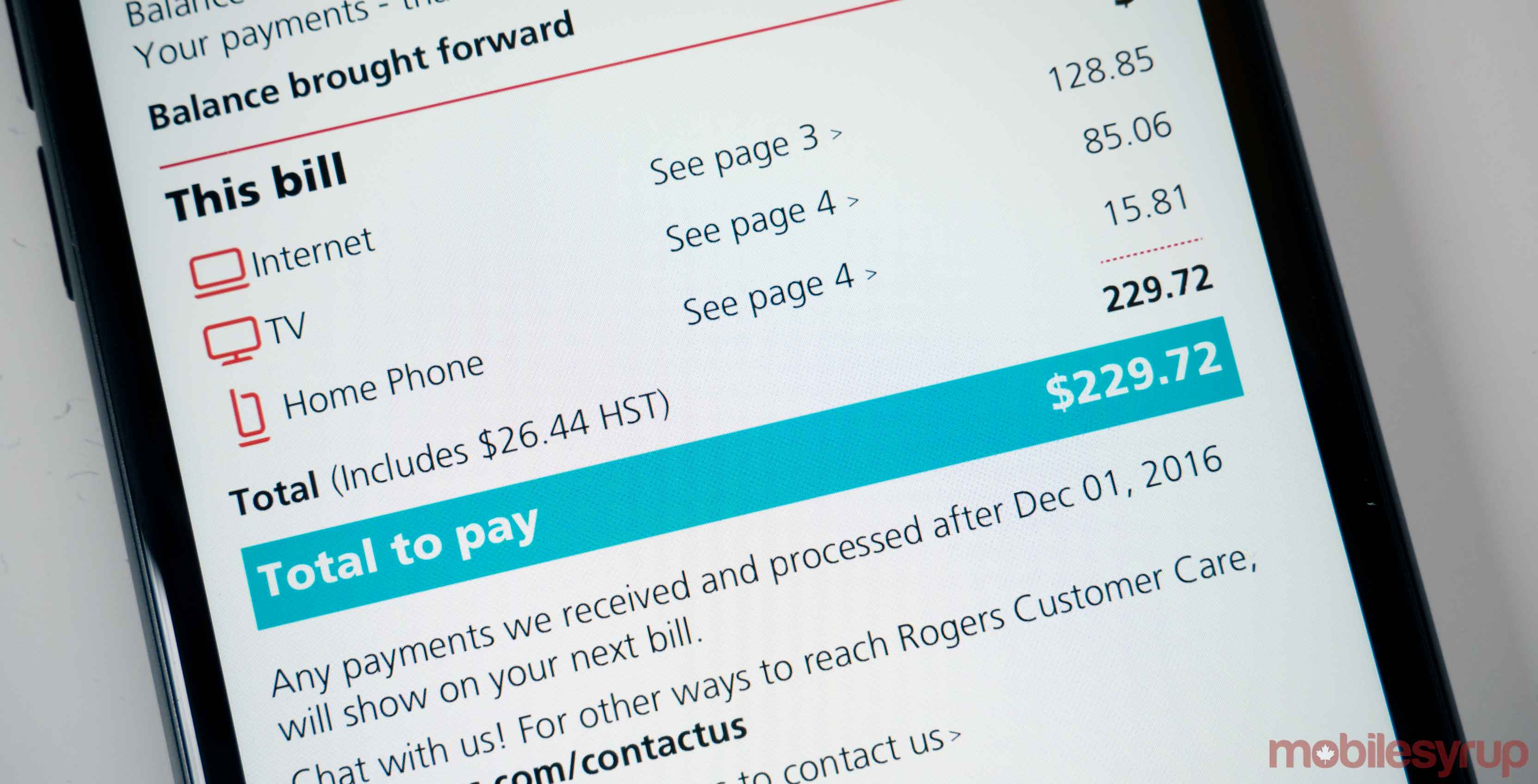

“If you are a subscriber to Crave, you pay HST, you pay sales tax. But that’s collected by Crave and remitted onto the government. If you subscribe to Netflix directly from Netflix, then Netflix does not collect and remit sales taxes. It doesn’t have a Canadian presence so it is not, at the moment, by law, required to do so,” said Canadian wireless law expert and University of Ottawa law professor, Michael Geist.

Any corporation selling products to Canadians, in Canada, is required by national commerce laws to impose a sales tax on their products to help reimburse the government for its permission to operate in the country.

Netflix has been able to avoid this requirement in two ways since its entry into Canada in 2010. The first method being that Netflix never opened a Canadian satellite office, and still hasn’t to this day. The government can’t tax a person or a company that has no in-country residence.

Secondly, Netflix doesn’t sell a physical product. This product doesn’t pass through a vendor that can institute such a tax at the point of sale, nor does it go through any other check and balance before reaching the consumer.

Through the power of the internet, Netflix has the ability to sell access to its service directly to Canadian customers without the oversight of any other body.

Geist goes on to say that a ‘Netflix Tax’ in its truest form refers to the simple fact that Canadian users of the service will see an extra few dollars accounting for the tax on their monthly bills.

The Minister of Finance has said in the past, however, that it will not impose such a tax on Netflix and has no plans to do so in the future.

“As we’ve said before, we have no plans to put a tax on Netflix. Our tax fairness measures are focused on looking at the tax system to ensure it better supports the middle-class — including increasing taxes on the wealthiest Canadians so we could cut them for the middle-class.”

This kind of tax would likely apply to all similar streaming services that reach a certain number of Canadians every month. A prime example of a similar company that may be affected is Spotify, a music streaming service that operates in much the same way as Netflix; one monthly subscription rate for access to a whole swath of music.

Definition #2: Can-con contributions from Netflix

The term, “Netflix Tax” has also been used to pose the question of whether companies like Netflix should contribute to can-con (Canadian content) as part of the requirement of operating in the country.

The debate has centred around whether or not the video streaming giant should be required to pay into the Canadian Media Fund (CMF). CMF is an organization funded jointly by the Canadian government and IPTV and satellite providers. The group delivers funding and support to Canadian television and digital media through a few different funding models.

If Netflix fell under the Broadcasting Act, it would be required to make certain financial commitments to Canadian content, which would likely include paying into the Fund.

Netflix has claimed time and time again that it contributes willingly and substantially to the production of original Canadian content, without being mandated to do so.

Geist agrees, stating that Netflix has indeed served Canada’s local artists of its own volition.

“We’ve got a system that’s actually working pretty well in terms of marketplace based incentives and real successes for can-con in the Netflix space and a contribution requirement for those that have certain advantages that aren’t accorded to competitive OTT (over-the-top) players,” said Geist.

According to an article written by Geist, Canadian Heritage Minister Melanie Jolie has remained adamant that the government will not extend mandatory can-con contributions to Netflix.

“I think that when the Minister talks about doing a better job of promoting can-con she’s right,” continues Geist. “I think the goal is to find ways to bring Canadian content to bigger audiences and take advantages of the real competition that’s emerged in the streaming space.”

Some of the methods by which the video streaming company has done this include partnering with local broadcasters and streaming services to hire Canadian artists to produce local content.

The Department of Heritage has stated recently that they will not impose can-con requirements on Netflix.

Definition #3: Taxing the Internet

In addition, while the term ‘Netflix Tax’ has often been used to refer to the discussions around whether Netflix should give back to Canada in the form of a GST sales tax or a can-con mandate, a larger discussion about the freedom of the internet has emerged.

The growth of businesses in the digital age, and the desire of Canadians to access their services will likely force amendments to made to existing taxation and content laws.

This kind of tax would effectively be a levy on Canadian monthly wireless bills to be issued through their wireless carrier. The response to this hasn’t been positive, and several wireless advocacy groups have spoken out against the proposition.

In particular, OpenMedia, a wireless advocacy group, has been vocal on the subject. A representative from the group, David Christopher, explained their position in an interview.

“The high cost of internet access is almost crowding out the entertainment budget that families have. That’s just one of the many problems bringing up the question of availability,” said Christopher.

He went on to say that Canadians already pay so much in wireless fees that a big part of the reason why they’re not watching Canadian content is because there isn’t room in their budgets to purchase it.

This broader discussion, however, would be better referred to as the Internet Tax, which has stirred up tensions among several digital freedom advocacy groups.

The conversation about a Netflix tax has evolved into a precedent-setting discussion about the freedom of digital services and the laws that protect that freedom.

Geist agrees that the concept is a dangerous one, urging regulators to tread carefully as they navigate these discussions.

“The third area that some have raised is taxing ISPs, taxing the internet service itself. A lot of Canadians are already concerned with the cost of their internet services, the notion of making it even more expensive with that sort of extra fee would be hugely concerning” Geist said in an interview.

There’s nothing to worry about, yet

While many groups have argued that virtue of the web lies in the freedom of anyone to access it, it’s not clear whether the evolution of tax laws and commercial enterprise will affect that freedom.

It’s important to remember that as these discussions about Netflix are taking place, other digital services will likely follow suit as these laws are more widely adopted.

It’s become clear, however, that much of the anxiety surrounding the legislation of the internet has been conflated with the Netflix Tax. While several countries have experimented with such legislation, Geist concludes that this kind of legislation will likely be introduced in Canada eventually.

As of right now however, none of these proposals has been instituted by the Canadian government. So it seems that both Netflix and Canadian video streaming junkies are off the hook, for now.

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.