Xioami has, according to the Wall Street Journal, raised $1 billion in funding, bringing its value to an Uber-like $45 billion.

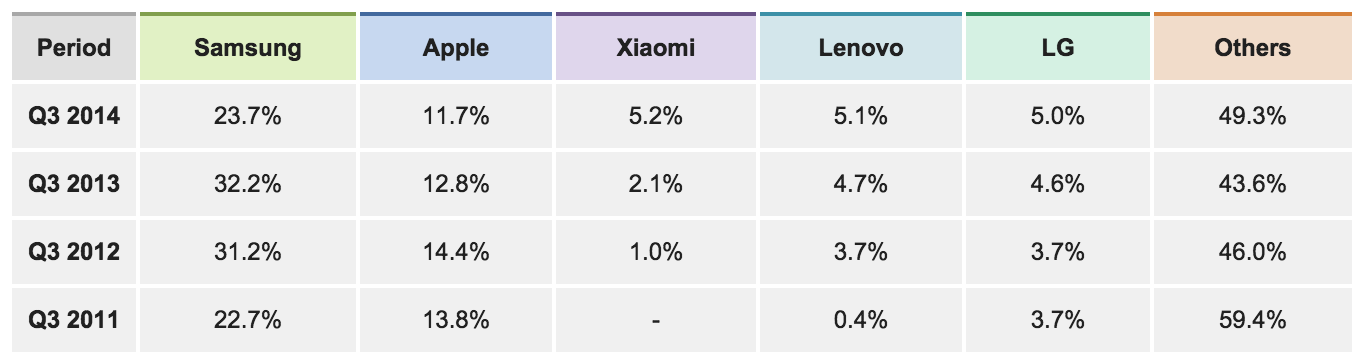

The growth of the Chinese OEM has been astronomical in recent years, building from practically nothing to the third-biggest phone manufacturer in the world in under three years. As of Q3 2014, according to IDC, Xiaomi sits behind only Apple and Samsung with 5.2% of the worldwide smartphone share, despite being relegated to China and its surrounding countries.

Samsung is still the world’s biggest smartphone OEM, and with 23.7% share it is unlikely to relinquish that title in the next 12 months — but its nearly 10% drop from a year earlier underscores the seriousness of the situation. Squeezed at both the high and low end, Samsung’s downward trajectory appears to be a certainty as upstarts like Xiaomi, Huawei, ZTE, Lenovo and Oppo undercut its flagships with well-spec’d devices half the cost.

Xiaomi may only be one of many Chinese OEMs vying for worldwide smartphone growth, but it is the one to most assiduously watch for. The company has an unprecedented online sales distribution channel that allows it to restock products that sell out in minutes or seconds. It has set up retail stores in Mainland China, and plans to market itself aggressively in India next year.

But the world’s most lucrative smartphone market, North America, is still out of reach for Xiaomi, even as it plans to unveil its new smartphone at CES early next year. The company is embroiled in patent litigation after being accused of infringing eight Ericsson patents, and the Chinese government is reportedly nearing a conclusion in its investigation of Qualcomm, which has been protecting Xiaomi and its competitors through cross-licensing agreements. It’s almost guaranteed that a Xiaomi handset would either be held up by the FTC or shot down by the FCC, and even if it was approved for use on American LTE networks, big-name telcos like Verizon and AT&T would likely shy away from stocking them in fear of alienating Samsung.

That said, with the success of the OnePlus One, which has been sold to North Americans entirely through its website, Xiaomi could find other ways to enter the U.S. market. Its current Mi4 device has been certified for Google Play Services outside of China, a roadblock that has hindered certain devices in the past, and it can be purchased unlocked to run on any North American LTE network, including Rogers, Bell and TELUS.

Samsung is also said to be preparing to change its product release strategy in 2015, focusing on fewer, higher-quality handsets like an all-metal, curved display Galaxy S6, which will likely be unveiled in February at MWC.

[source]WSJ[/source]

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.