Cryptocurrencies have been around for most of the last decade but have seen significant adoption in the past three to four years, with hordes of retail and institutional investors ‘HODLing’ (holding on for dear life) and trading digital assets.

The cumulative ‘crypto market cap’ has increased from about $906 billion (roughly $1.150 trillion CAD) on January 1st, 2021, to about $1.876 trillion (roughly $2.381 trillion), as of writing.

According to a 2021 statistic, about 1.2 million Canadians, or 3.2 percent of Canada’s total population, currently own cryptocurrency. Other reports have shown that about one in four surveyed Canadians currently own cryptocurrencies, with the majority of those having entered the digital asset race in the last six to 12 months.

Similar to any other source of earning fiat money, gains made on cryptocurrencies, or any byproduct of it — including but not limited to NFTs, DAOs, staking, liquidity mining and Airdrops — are all subject to tax in Canada. Fiat money refers to any currency that is made legal tender by a government, with no significant backing for its value. For example, a $5 bill itself doesn’t hold any value as it’s just a piece of paper, but because the government says a $5 bill is worth $5, we can use it for purchasing commodities, goods and services.

Since this is a relatively new sector for many Canadians, several of whom will likely be filing their crypto taxes for the first time this year, let’s see what rules the feds have laid out and how to go about reporting your crypto income.

Taxes for the financial year 2021 must be paid by April 30th, 2022.

A general rule to remember is that you’ll only have to pay tax on your profits. For example, if you spend $1,000 to purchase a fraction of a bitcoin, you won’t have to pay any tax for the transaction because the amount of bitcoin you receive is equal to the fiat currency you deposited.

But let’s say you HODL’ed your bitcoin, it appreciates in value, and you sell it for $1,500 or convert it into a stable coin — you’ll have to pay tax on the gain.

Similarly, if you gift your appreciated asset, or use it to buy services, commodities or goods, you’ll be subject to paying crypto tax.

According to the CRA, transactions involving cryptocurrencies fall either under business income or capital gains and are taxed accordingly.

While there is no solid laid out criteria to determine where your trades fall, here are a few pointers from the CRA about business income that you should know:

- You carry on the activity for commercial reasons and in a commercially viable way

- You undertake activities in a business-like manner, which might include preparing a business plan and acquiring capital assets or inventory

- You promote a product or service

- You show that you intend to make a profit, even if you are unlikely to do so in the short term

According to the CRA, “Business activities normally involve some regularity or a repetitive process over time. Each situation has to be looked at separately.”

If you fall under the business income slab, you’ll have to report your crypto gains with the income tax from your regular job. So let’s say you make $70,000 from your regular job annually, and you make crypto gains of $10,000 during the year, you’ll fall under the 20.5 percent federal tax bracket with the total yearly income of $80,000.

It’s worth noting that mining crypto, getting staking rewards, liquidity providing rewards or getting paid in crypto are considered business activities and, hence, would fall under business income.

“If the sale of a cryptocurrency does not constitute carrying on a business, and the amount it sells for is more than the original purchase price or its adjusted cost base, then the taxpayer has realized a capital gain,” reads CRA’s crypto tax guide.

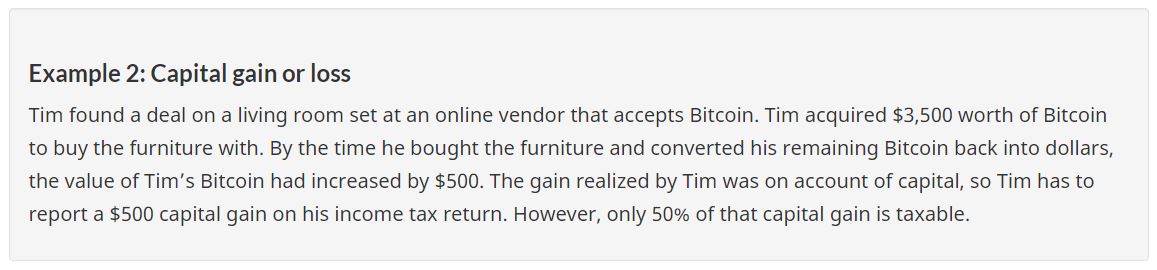

If your activity falls under capital gains (hobby), you only pay tax on 50 percent of the newly-acquired capital. For example, you started 2021 with $10,000 worth of crypto, and by the end of the year, that amount appreciates to $16,000, your capital gain for the year is $6,000. You pay tax on 50 percent of the gain, so $3,000 is your taxable capital gain for the year.

While the line to distinguish capital gains from business income is very thin, CRA’s example about capital gains might put things into perspective:

Image credit: Government of Canada

It’s worth noting that simply HODLing crypto assets or transferring them between your own wallets is not a taxable activity. You are liable to pay tax only when you convert said asset to a different digital asset, a stable coin, fiat currency, acquire a service or good with it or gift it to someone.

Since filing crypto taxes would be a new activity some Canadians would have to partake in this year, it would be prudent to have an expert assist you, file the taxes for you, or go through your file once you’ve put it together. Said experts can also help you determine whether your activity would be considered under capital gains or business income.

Additionally, some tools on the market can make it fairly easy for you to put together your transaction history and determine whether you are net positive or negative.

One of the most efficient and easy-to-use tools on the market right now is CRA-compliant Koinly.

While it is shrewd to maintain an Excel sheet with all your trades, from the moment you initiate them to the point of selling, you don’t need to worry too much if you haven’t been on top of your trade history.

https://twitter.com/koinly/status/1493475732428935171

Almost all centralized and decentralized exchanges have a history section, where you can procure the date, timing, cost and currencies exchanged from the trade. Koinly makes procuring the information even simpler.

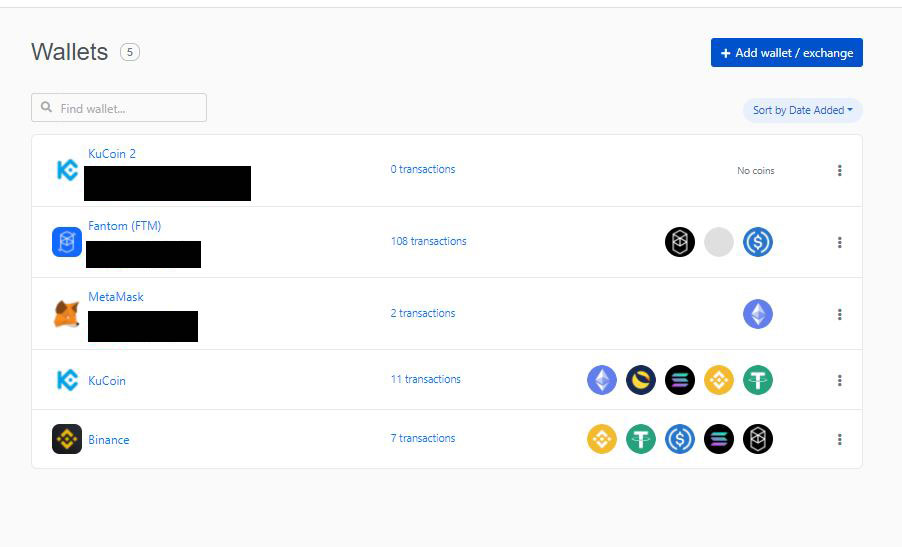

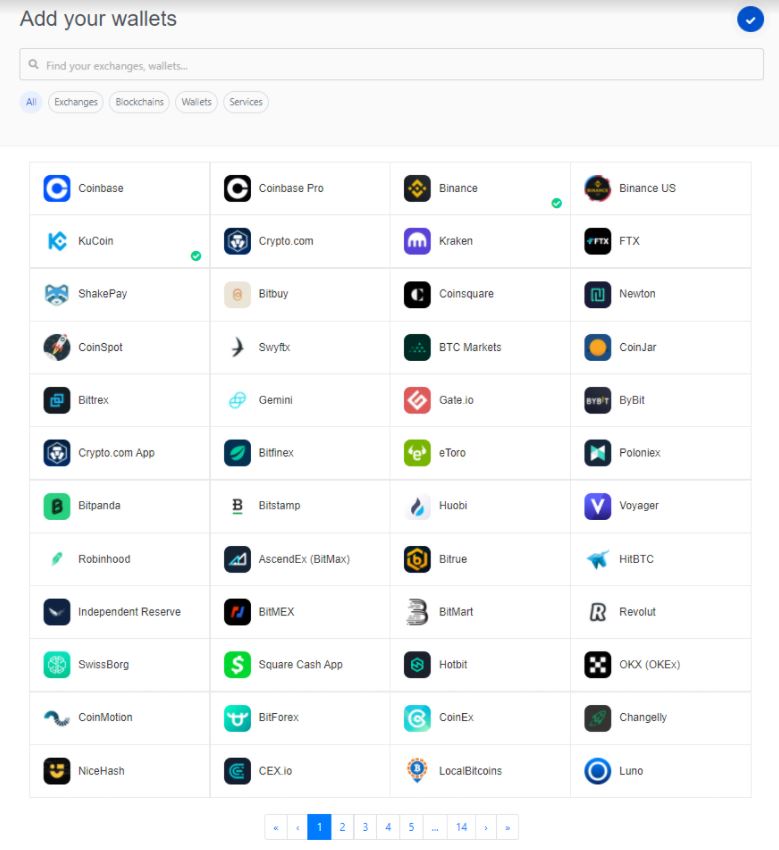

The application has integration with numerous top exchanges in Canada and abroad, including, but not limited to Binance, KuCoin, Coinbase, Crypto.com, Kraken, FTX, ShakePay, Newton, BitBuy and many more.

Image credit: Koinly

In the app, you can choose to connect your wallet directly with your API and public address or you can download your transaction history from the exchange you use, and upload the file to Koinly.

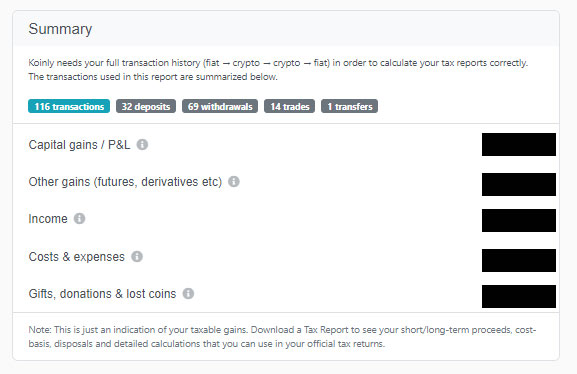

The app is useful not just for taxes, but also to maintain an understanding of where your money is going, the number of transactions on your account and how much you’re spending on trading fees. Additionally, its website has numerous articles about how digital assets are taxed in Canada, which can help you understand the procedure better and determine whether your investments/trades fall under capital gain or business income.

What makes the app a one-stop-shop is that it also supports tax calculations for gains/income earned through flipping or holding NFTs, staking assets, rewards from liquidity pools and airdrops, and it does all that automatically and in real-time. Oh, and did I mention that Koinly’s Twitter page is full of crypto tax-related memes?

Jokes aside, I would advise that you manually go over all the transactions that Koinly pulls from your wallet to make sure there are no discrepancies. In case the CRA audits your file, and there are inconsistencies between what you reported and what you actually transacted, you might have to pay a penalty.

https://twitter.com/koinly/status/1488984542270607363

Koinly is free to use if you just want to keep track of your transaction history, net gain/loss, however, if you want to generate tax forms through the app, you’ll have to buy a plan. Koinly’s plans start at $49 (roughly $62 CAD) for a 100 transaction or less tax form, perfect if you’re someone who has dabbled around with digital assets in the past year.

It then has a $99 (roughly $125) plan that gives you access to tax reports with 1,000 or fewer transactions made in the last year. Following that are Koinly’s $179 (roughly $227 CAD) and $279 (roughly $353 CAD) plans, which give you access to tax forms with 3,000 and 10,000 transactions, respectively, perfect for those who are day trading digital assets.

Once you get the filled-out forms, you can proceed to file them yourself, or forward them to your tax adviser/agent/accountant.

As of right now, the only reliable way to use Koinly is on web. While the company has apps for iOS and Android, they are still in Beta, so I recommend that you avoid using them until a stable release.

Header image credit: Shutterstock

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.