Vidéotron lobbed a bomb at the incumbent wireless carriers today, launching a new portal called Wireless For Less and hinting at a possible expansion of its wireless network to provinces like Ontario, Alberta and British Columbia, in which it owns premium 700Mhz spectrum.

Newly-minted Quebecor CEO, Pierre Dion, took the stage at the final keynote of the Canadian Telecom Summit to reinforce many of the points made yesterday by Wind Mobile chairman, Tony Lacavera: mobile data in Canada is too expensive, and our productivity suffers as a result.

Dion shocked the audience by announcing his company is “contemplating the possibility of consolidation with one or two of the undercapitalized new wireless entrants,” hinting at an acquisition or merger of Wind or Mobilicity. “If completed, this would allow us to almost triple our customer base,” he said. “Under the right conditions we are ready, willing and able

to become Canada’s fourth wireless competitor,” and denounced the current state of mobile in Canada.

“We are uniquely positioned to provide highly-attractive wireless plans to Canadians looking for top-quality service at very competitive prices,” citing investment of $1.6 billion in towers and spectrum, which includes the $233 million spent on 700Mhz blocks earlier this year.

“Vidéotron’s plan is based upon achieving meaningful market penetration through offering Canadians outside Quebec the country’s

best low-cost subscriber plans. The major investments we have made and intend to make in spectrum, expanded network and consolidation with willing partners, would enable us to deliver genuinely competitive, low cost, high quality wireless services to consumers.”

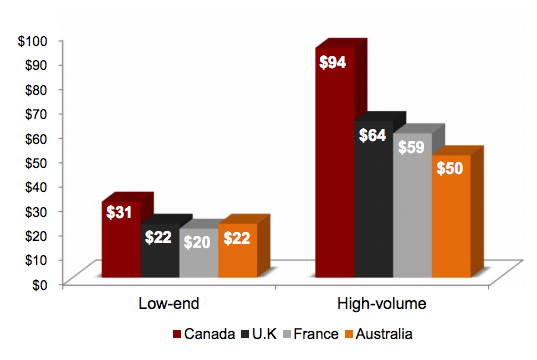

Dion said that most incumbents justify their higher prices by placing them against those from AT&T and Verizon, but that is not a fair comparison: North Americans typically pay 50% more for the same data pool as those in Europe.

He also decried the cost of domestic roaming, which the government is set to regulate later this year. Being able to connect, affordably, to a competitor’s tower, is one way that will allow new entrants to offer national without having to build out thousands of cell sites. Dion pointed out that tower sharing is also prohibitively expensive for new entrants, as incumbents are not forced to offer access leased or rented towers.

Dion said his company’s move to become a fourth national carrier hinges on the government’s next steps towards regulating domestic roaming, but it’s clear the potential to begin offering substantially discounted service — and potentially LTE services, to boot — is quite real.

[source]Affordable Wireless[/source]

Image Credit: Le Devoir

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.