Suretap Wallet certainly wants to be the one-stop portal for all things digital wallet, but it’s had a remarkably difficult time getting there. Just look at its horrendous 1.9-star rating on the Google Play Store to understand why.

Earlier this year, parent company Suretap was spun off from Rogers, where it began its life as the consumer-facing side of the carrier’s mobile payments endeavors. Since then, Suretap Wallet, an app for Android and BlackBerry 10, has expanded to support Bell and Telus and their respective flanker brands, while promising to bring a number of new features to the table.

Last week, as Christmas approached, Suretap quietly released major updates to its Wallet app for BlackBerry and Android, overhauling the interface and gearing up for the company’s next permutation. On Android, where the majority of its customers reside, Suretap Wallet removed the need for an NFC-enabled SIM card to log in and use the app, though one is still needed to add and make payments with a credit card.

This doesn’t mean that, as RBC did earlier this year, Suretap Wallet now supports payments using the Host Card Emulation standard. Indeed, it still relies on secure element-based SIM cards to make those payments, limiting the app (for that purpose) to the 31 BlackBerry, LG, Samsung and HTC-based smartphones on its list, but the app is now considerably more user-friendly than it used to be.

So what else is new? The Suretap Wallet app looks considerably nicer than it used to, with an elegant carousel format that exposes the utter dearth of functionality within. While Suretap promises more options soon, the only thing one can currently do in the app is add and redeem a series of gift cards from companies like Cineplex, Cara Brands (Harvey’s, Swiss Chalet, Second Cup) and others.

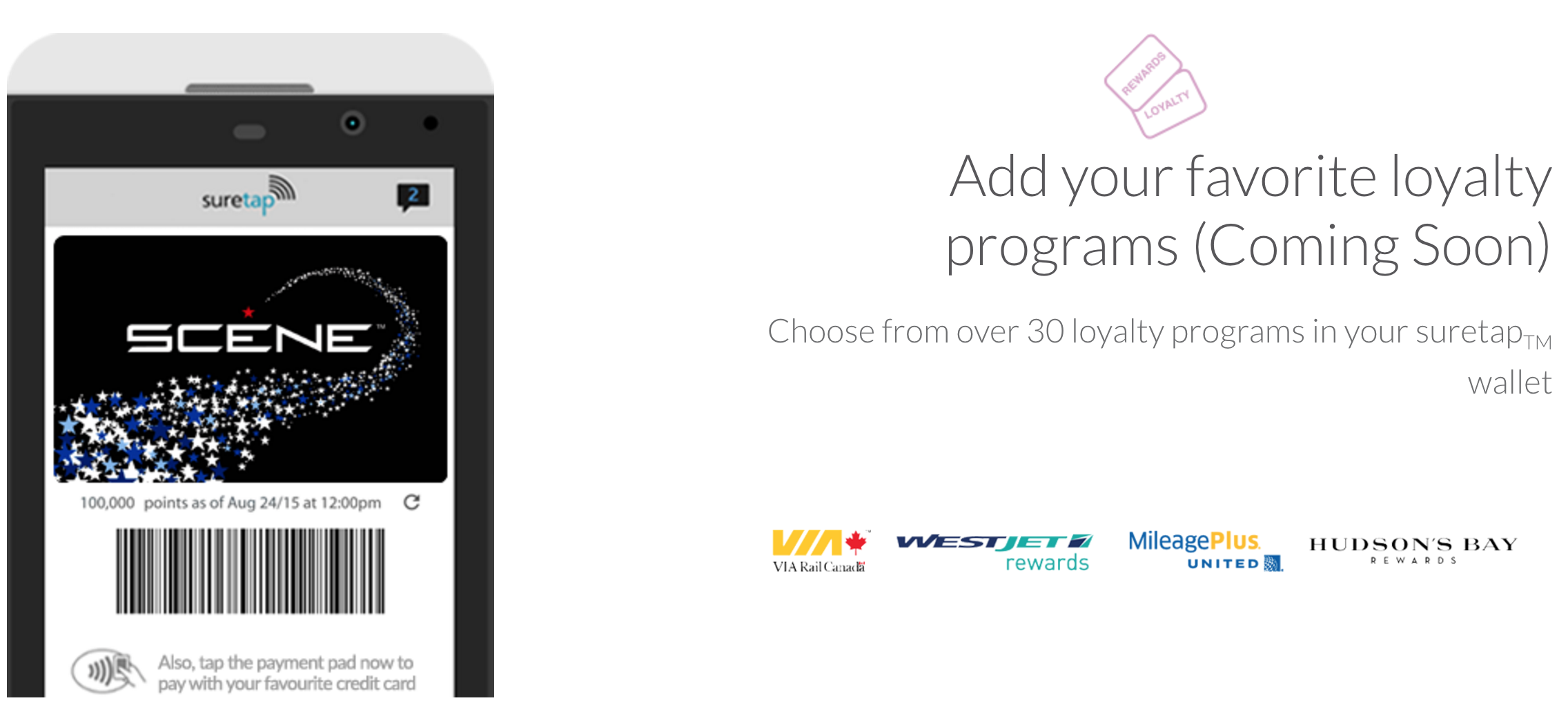

In the future, Suretap Wallet plans to support loyalty cards, as well as a wide range of credit cards — for compatible devices, it currently offers a range of CIBC Visa cards as well as a prepaid MasterCard issued through the app itself — and bills itself as a single point of origin for all physical and digital transactions.

These changes bring it part of the way there, but Suretap, like mobile payments in general across this country, is in a period of transition, waiting for the adoption rate, and comfort level, to climb to a point where people demand this kind of product. In the meantime, Suretap likely figured, as competitor UGO Wallet did earlier this year, that limiting its user base to a small sliver of Canadians was a bad business decision.

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.