365 days of cut-throat competition. 365 days of carriers losing and winning customers. 365 days of surging mobile technology. 2011 was a benchmark year for Canadian wireless and brought very notable accomplishments. However, all the efforts in the last year will actually setup 2012 for massive success – for both the customers and the industry.

2011 was the year that Canadians fell deeper in love with their phones. The phones became faster, thinner, lighter, and graced our hands with large displays. The average wireless customer was pining for the latest device, unfortunately it wasn’t a BlackBerry, but the newest “Android”. It was the first year that I can think of that more people were asking about Android that any other, yes, more that Apple’s iPhone. At some point over the past 52 weeks Google’s “open source” OS was top of mind. Was it the Samsung Galaxy SII or the Galaxy Nexus that caught Canadian’s attention? Could it be the massive, gorgeous and vibrant display? Perhaps it was how thin it was? Maybe even its dual-core speeds. Or was it the HTC Sensation? Or the Motorola RAZR – all thin. Wait, what about the Sony Ericsson Play – a “certified PlayStation” gaming device that was first launched in Canada, then in the United States. Whatever it was, Android made its astounding leap in 2011 – two years after Rogers declared the “Android Revolution” started. September 2011 comScore data revealed that 25% of all smartphones in Canada are powered by Android, up from 12.2% in March.

The hype behind the iPhone is still powerful, but not as intense as it was a couple years ago. The same comScore report showed Apple owning 30.1% of the Canadian market. Most likely Apple would have elevated even further if the rumours of the “iPhone 5” actually panned out. This was the biggest roller coaster ride of 2011. Analysts and overseas reports promised a complete iPhone redesign with a faster processor, better camera, thinner, aluminum backing, glass backing, antenna change, bigger display etc…, we ended up with the same phone, but “better”. Apple shouted it’s the best iPhone yet with a new A5 processor and better 8MP camera, plus Siri the voice assistant. Even without a change in design, lineups happened and Apple sold over 4 million in the first 3 days.

So, according to comScore, Android and iOS have a combined market share of 55.1%. RIM, once acknowledged as an innovator, claimed 35.8% Canadian market share, but unfortunately started to sink really fast. Even with their 75 million BlackBerry subscribers RIM was riddled with embarassment. Customers were more interested in large and powerful touchscreen devices and RIM delivered familiar “iconic” QWERTY devices. The most impressive BlackBerry on the market is the Bold 9900; it’s sleek, upscale, has a touchscreen and a QWERTY keyboard. It’s the best of both worlds, but it came late to the party. The Torch 9810 and 9810 didn’t prove to be profitable, nor did the all-touch Curve 9380 or the Bold 9790.

We could continue to talk about the ongoing trademark infringement cases, poor BlackBerry tablet sales, services outages, drunken RIM employees, low stock price, upset shareholders, delay of the PlayBook OS until February 2012, or even that their next-gen devices, now named “BlackBerry 10”, are also delayed until the “latter part of 2012″… but what would it accomplish? The bottom line is that RIM hit an unimaginable level in 2011 and absolutely needs to step up and deliver in every possible way in 2012. They need to act like their most recent tagline and “Be Bold”.

Carrier competition was a daily experience. I remember speaking with Anthony Booth, Mobilicity Chief Customer Officer, when he first started his new gig. Booth came from Mars Canada (the chocolate bar) where he was Vice President Marketing. He stated to me that he had never seen competition like this and that “it happens daily”. No other industry is like wireless, it cannot be duplicated. The carriers battled it out in 2011, but the Big 3 prevailed and drastically increased their subscriber base.

Rogers still is king in Canada with the most subscribers. In Q3 big red reported their subscriber base reached 9,288,000, Bell has 7,369,596, and TELUS has 7.2 million – totalling over 23 million subscribers. As for the “newer” wireless players, WIND is inching towards 400,000 subs, Mobility has “attracted” a total of 250,000, Videotron racked up 253,900, and Public Mobile has over 153,000. In addition to these numbers there is SaskTel, MTS – when these numbers are compiled the Canadian wireless subscriber base is well over 26 million, and growing. Prepaid subs at the Big 3 decreased while Postpaid subs increased. The busy Q4 numbers will be announced in January/February and it’s estimated that the year-over-year growth will be between 2-5%.

Just a couple weeks ago there rumours in the industry that WIND Mobile was “in talks” to buy Mobilicity. Both carriers declined to comment, but it would be reasonable to predict that 2012 will see carrier consolidation. The new entrants cannot keep this low handset and low monthly voice and data plans offering up another year. Something has to happen. Perhaps Mobilicity will merge with another, or it might be Pubic Mobile that gets gobbled up. Regardless, 2012 we’ll see one of the new entrants vanish. How the government lays out the upcoming 700Mhz auction will help speed this along – will or won’t they have a set aside?

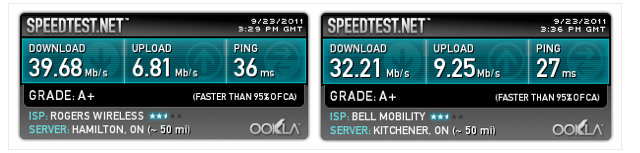

One of the major trends in 2011 was the continued adoption of smartphones and data devices. All the carriers reported that smartphone usage increased, now representing above 40% of their total postpaid subscriber base. Gone are the days of a simple flip phone – people are demanding devices with more capabilities. With Canadians wanting to be connected all the time – weather to download Angry Birds, log onto Facebook, Twitter, check their email, or even watch movies, 2011 brought LTE (Long Term Evolution) to the forefront for some lucky Canadians. Rogers and Bell successfully deployed their LTE networks across Canada, bringing “peak download speeds of up to 75 Mbps” – in reality it was between 12 Mbps to 25 Mbps. Both carriers coverage map reaches millions of customers (Rogers at 8 million, Bell claims just over 3.5 million) from Yellowknife to Vancouver, Ottawa and Halifax. Mass adoption has not happened yet, 2011 was more of “who can get to market first”, and came with ridiculous pricing for devices and plans. 2012 will be very different. TELUS will join the fun, along with Virgin, SaskTel, and MTS and this should drop the prices a bit.

All this new found speed will should finally allow for a greater adoption of mobile content, something that’s been predicted since the Vancouver Olympics. Next year will see a dramatic spike in the way we use our smartphones or tablets. Watching movies, videos and TV (news, sports, syndicated shows) on the go will be the norm. But this will come at a cost of course. Carriers will have to create a better, more affordable pricing structure to make this happen.

Finally, 2011 had minor progress for mobile banking. Sure, Canadians bank by phone, but it’s simply just to transfer funds, check balances or find the closest ATM. The closest thing we had to actually paying for products and services from our smartphone was the BMO and MasterCard “Mobile PayPass Tag”. This gave those who signed up for each service the ability to place a sticker on the back of their clean looking, well designed handset. Something that just destroyed its look. It’s hideous and odd looking, but I understand that it’s a stepping stone to having more devices come with NFC capabilities. NFC (Near Field Communications) has made its way into the Galaxy Nexus, Nexus S, BlackBerry Bold 9900 and the BlackBerry Curve 9360 – more devices are on tap for 2012 and so is mobile wallet/payment competition. EnStream, the Big 3 joint venture venture, will launch their mobile payment app, plus Google will launch Google Wallet in Canada.

2011 was fundamental for wireless in Canada – but it’s 2012 that will be spectacular. The handsets will become more powerful, speed will be at a premium, mobile content and mobile banking will be at the forefront, the 700Mhz spectrum auction will raise billions for the government, Shaw and Eastlink will launch their wireless networks, plus every carrier will continue to compete for customer loyalty on a daily basis… unfortunately the low-cost subsidy pricing of 3-year contracts will still exist.

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.