A report co-authored by a pair of University of Calgary associates for The School of Public Policy posits “there is no evidence that there is a competition problem in wireless services in Canada.”

Jeffrey Church, Professor of Economics and Director of the Digital Economy Program, along with Andrew Wilkins, Research Associate for the Digital Economy Program, penned a 50-page report released today that takes issue with many of the Canadian government’s newly-implemented policies looking to foster increased competition in the wireless market.

Instead of paying higher prices than the rest of the world, the paper observes, Canadians pay exactly what the market can bear, since the country emphasizes postpaid service and our incumbent carriers offer faster and more reliable wireless than countries with similar penetration.

Moreover, the amount of revenue and, indeed, profit taken in by the Big Three are in line with many of the other OECD-based carriers, despite a higher blended ARPU, owing to the fact that Bell, Rogers and TELUS invest comparatively more in infrastructure and capital expenditures than many other privately-owned telcos.

The report argues that the government’s interventionist regulations will only have a short-term impact in pricing, which would return to modern levels as companies consolidate in order to raise margins in light of artificially propped-up competition.

Canadian telcos’ historically-higher blended ARPU is also explained by disparate billing practices, whereby US and Canadian providers typically bill senders and receivers for the minutes used; European and Asian telcos only bill the sender. Canada’s quickly-dropped prepaid market, which also contributes to lower ARPU, is another facet in the country’s seemingly-higher revenue share per customer.

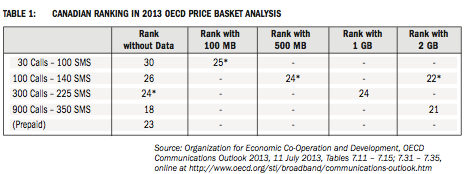

The report dismisses many of the OECD’s findings from earlier this year, taking issue with their reporting methodology. It’s worth noting, though, that the incumbent carriers used that OECD data to place Canada’s pricing in the middle of the pack. While the report admits that Canadians pay some of the highest prices in the world for prepaid data and low-usage postpaid plans, the carriers rank somewhere in the middle for medium and high-usage plans.

Going back to the carriers themselves, the report explains that, in light of a government-induced fourth national carrier, “there is a minimum gross margin required for the marginal wireless service provider to be just profitable…[and] the number of wireless service providers will adjust in the long run to ensure this margin is realized.”

The report concludes by saying that the high price of building a national network, which includes remote regions outside high-density cities, is extremely high for a country of this size, and consolidation may be a necessary outcome of heavy-handed government regulation. “The commitment by the present government to enhance competition by committing to four competitors in every region is ill-advised. It is based on unsophisticated and misinformed textbook economics — that more competitors are better — which is simply inappropriate for services where there are important economies of network size, including economies of scale and scope,” it says, implying that the government’s recent decisions are a matter of vote-acquisition, and don’t have consumers’ interests at heart.

[source]Policy School (PDF)[/source] [via]Newswire[/via]

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.