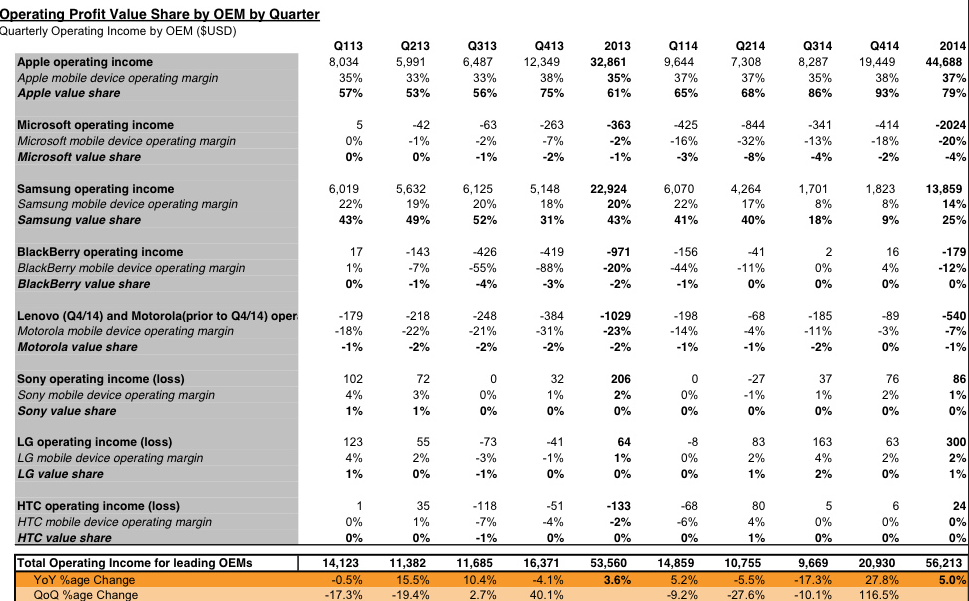

Canaccord Genuity’s Mike Walkley has landed quite bullish on Apple today, after his review of market data reveals that the company secured a whopping 93% of industry profits in Q4 of 2014. Comparatively, Samsung posted a minor profit value share of 9%, while most other companies stayed within the margins or posted a loss.

While staggering, Apple’s profit grab should not be surprising, considering the company just posted the most profitable quarter of any company, ever. Walkley goes even further in his report, however, predicting that Apple may own one third of all smartphone users by 2018:

We believe the strong iPhone 6 replacement sales should continue during C’15, as we estimate only 15% of the current estimated 404M iPhone installed base has upgraded to the new devices. We also anticipate continued strong share gains for the larger screen iPhones from high-tier Android smartphones during C’15 driving strong growth in the iPhone installed base and model the iPhone installed base growing to 487M subscribers exiting C’15 up 20% Y/Y. Longer term, we anticipate a gradually moderating rate of growth for the installed base from C’16 through C’18 and estimate 650M iPhone users exiting C’18. We note this base would only represent 1/3rd of an estimated 1.82B global premium smartphone subscribers anticipated by C’18. Finally, we anticipate steady long-term iPhone replacement sales within this growing iPhone installed base, and we believe this combined with our modest installed base growth expectations position Apple for steady sales of roughly 210M-215M iPhone units annually between C2015 to C2018.

While the Android market might consolidate in the face of a full-court press from Apple, companies like Samsung should continue to post significant profits.

[source]Barron’s[/source]

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.