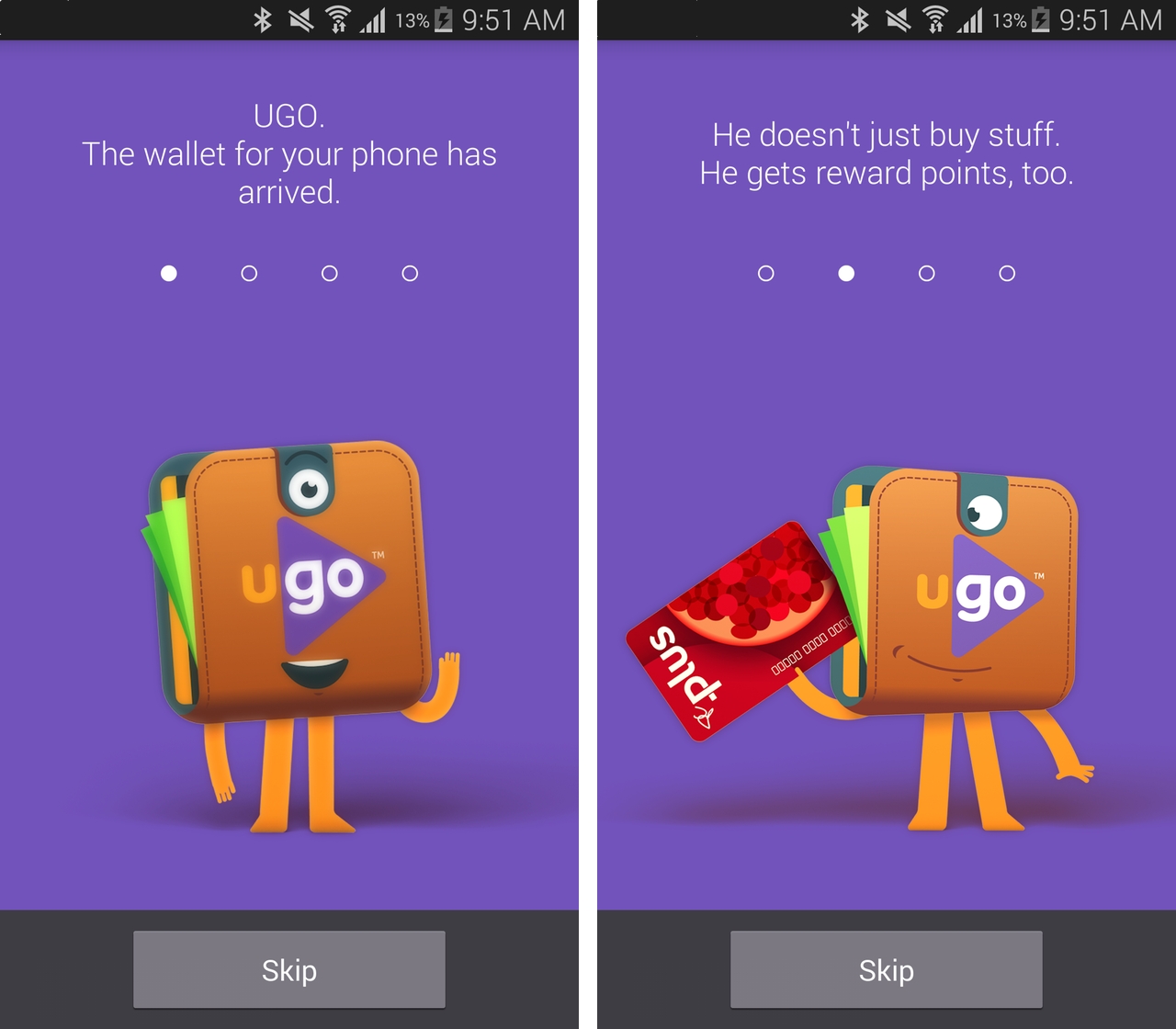

There’s a new mobile payment service in Canada, and it’s the first to combine touchless payments and loyalty in a single app.

Dubbed UGO Wallet, the service is a partnership between TD Canada Trust and PC Financial, whose credit cards are the first two participants in this so-called “open wallet.”

Similar to other mobile payment offerings on the market, UGO Wallet requires a particular Android or BlackBerry device — there are 15 at launch altogether — and an NFC SIM card, which is used to safely store payment credentials in its secure element.

The service works with Rogers, Bell and TELUS, but there are a few frustrating restrictions. Bell customers, for example, cannot add PC Financial MasterCards, and despite being available for purchase, NFC SIM cards from the Big Three’s subsidiaries, Fido, Virgin and Koodo, are not compatible.

Users can also add PC Plus loyalty cards, which can be used at Loblaws stores to earn and redeem points.

The process to add these cards is pretty seamless, and I was up and running on my Samsung Galaxy S5 in just a few minutes. But first, let’s go over which devices work with UGO Wallet:

• HTC One

• HTC One (M8)

• LG G2

• Samsung Galaxy Note 2

• Samsung Galaxy Note 3

• Samsung Galaxy S3

• Samsung Galaxy S4

• Samsung Galaxy S4 Mini

• Samsung Galaxy S5

• Samsung Galaxy Mega

• Sony Xperia Z1

• BlackBerry Q10

• BlackBerry Q5

• BlackBerry Z10

• BlackBerry Z30

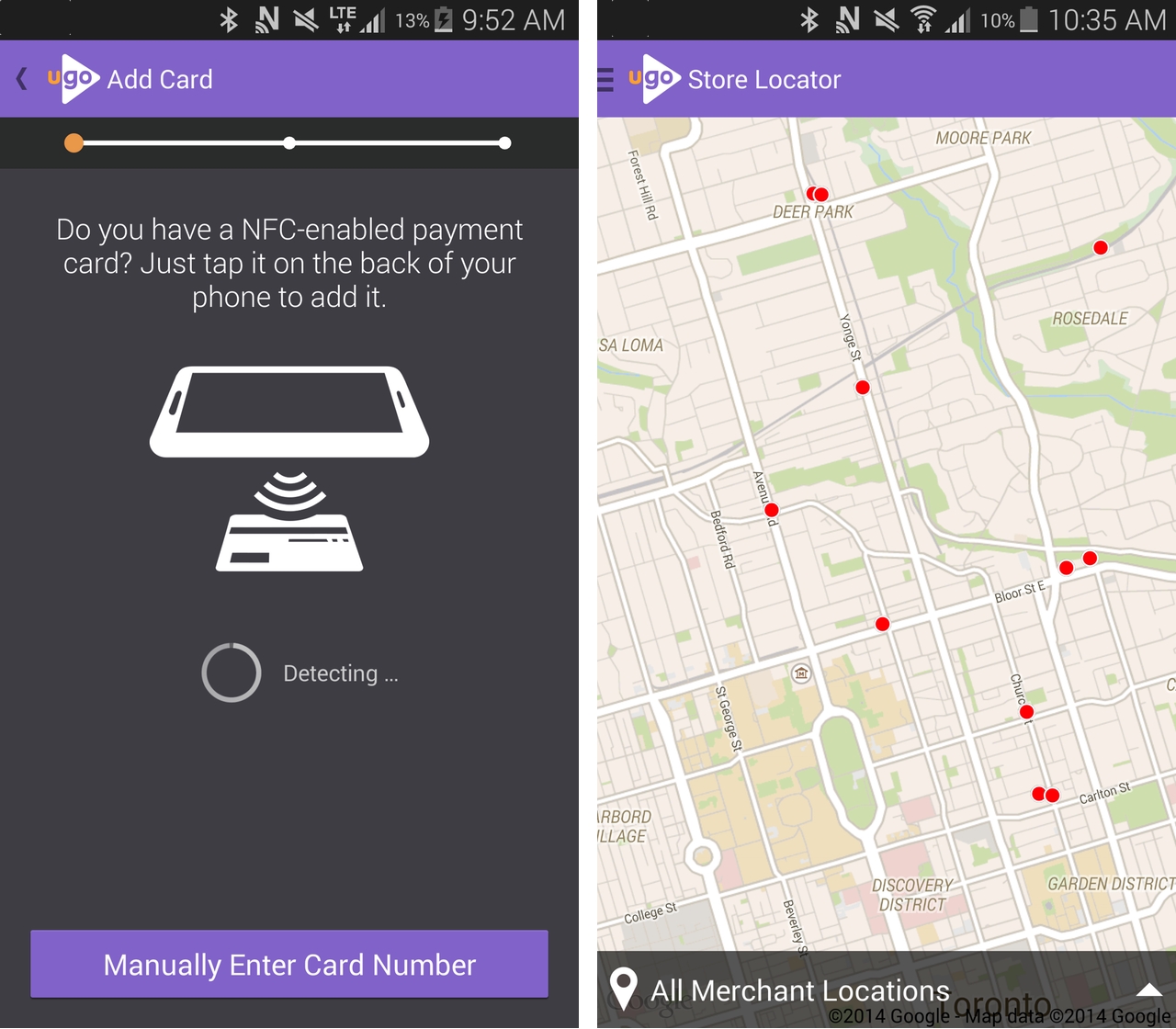

Adding a card is as simple as tapping it to the NFC terminal on the back of your phone. UGO Wallet uses the same NFC-based protocol, MasterCard PayPass or Visa PayWave, as the credit card itself, so transferring information between the two is fast and secure.

After automatically adding the card number from the front, UGO will ask to verify the three verification numbers on the back, as well as the PIN number to verify the card is yours. It then takes a few minutes to communicate with your bank and issue an “OK.”

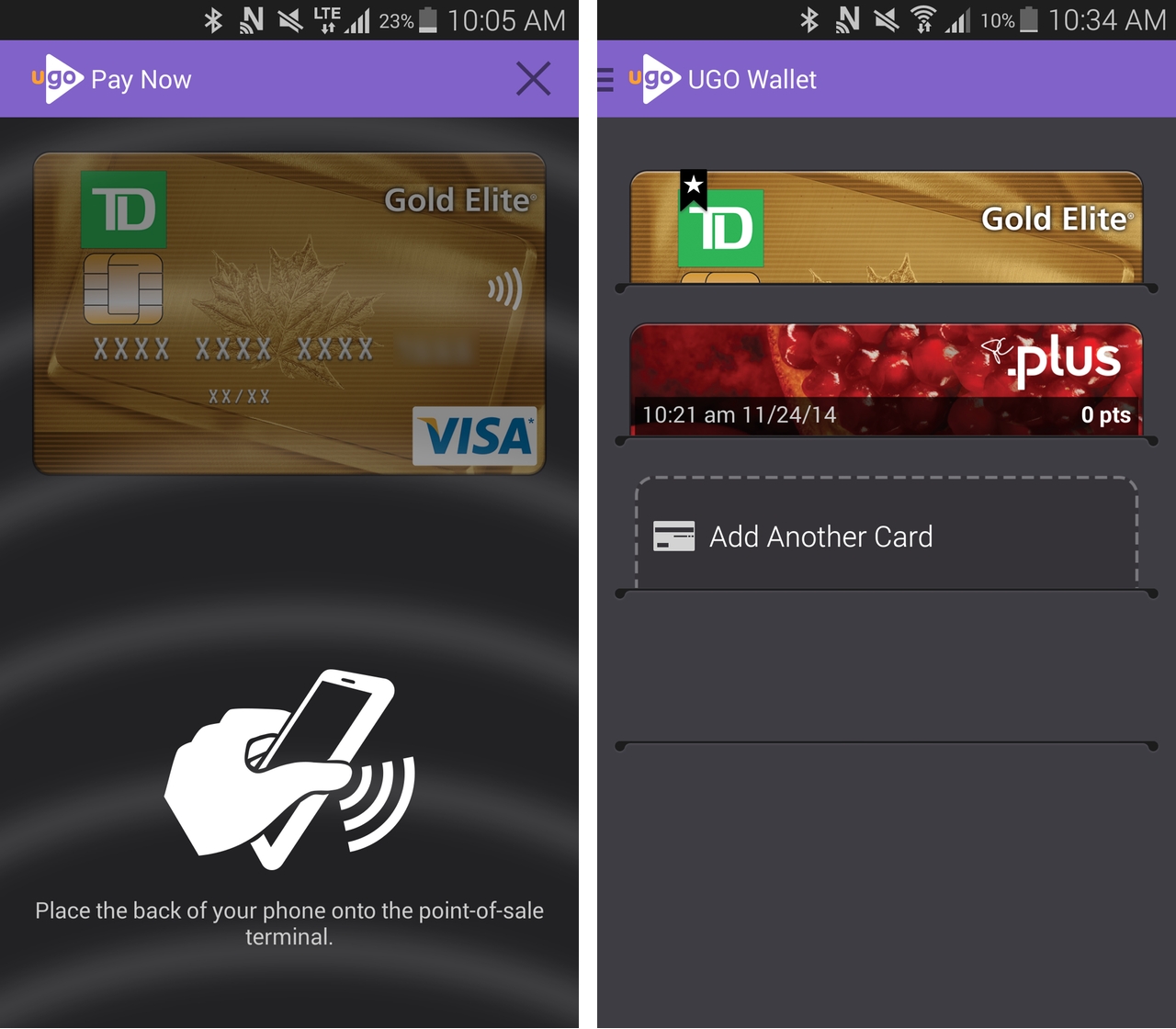

The app can store up to two credit cards and one loyalty card per SIM, a limit UGO says it is willing to reconsider if demand is high enough. The company says it is also reviewing compatibility with additional handsets, carriers and, most importantly, financial institutions.

The fact that UGO is an open wallet doesn’t offer a reprieve from the same limitations affecting many mobile payment services in Canada today. First, it is not compatible with iOS devices, and likely won’t be until Apple opens up the NFC antennas in its iPhone 6s beyond Apple Pay. It also works with a scant few devices, and is not keeping up with the Big Three’s release schedule — the Galaxy Note 4 is still incompatible, for example — which will need to be rectified in a hurry.

As for user experience, the app is well designed, reminiscent of Rogers’ seemingly-forgotten suretap wallet. Merchants set the payment limit, usually between $50 and $200, and users can require an additional passcode (in addition to the lock screen) before allowing the card to work. I used the wallet at wireless-friendly merchants like the LCBO and Loblaws, and the terminal treated my phone the same as a credit card; payments went through without issue. But there are thousands of smaller merchants that either haven’t upgraded their payment terminals, or don’t want to go through the hassle of enabling them, which negates the usefulness of the “leave your wallet at home” scenario mobile payments represents.

While TD Canada Trust’s Android and BlackBerry apps already allow users to make mobile payments, UGO Wallet provides a much more robust user experience, and the addition of PC Plus adds that loyalty component essential to user acquisition. The speed at which UGO brings new banks, devices and carriers to market will determine its success, especially since Apple Pay’s Canadian is looming.

[source]Google Play, BlackBerry World[/source][via]UGO Wallet[/via]

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.