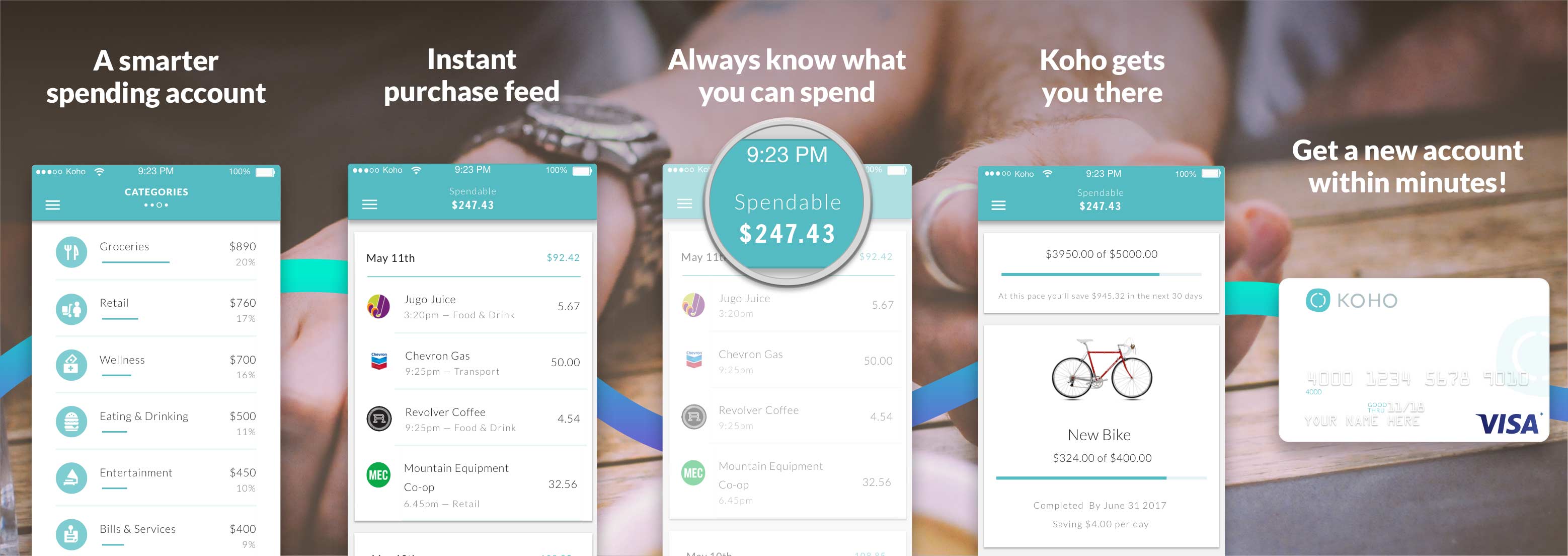

Vancouver-based financial insights startup Koho is launching exclusively across Canada this week. Koho is a mobile hub that allows users to manage their money via a mobile app and the reloadable prepaid Koho Visa card.

Koho users can use their prepaid Visa card anywhere Visa is accepted, while taking advantage of benefits like real time updates, automatic savings goals, instant transfers to others using the service, spending insights, chat support and low balance notifications.

“We’ve seen a lot of this in the news lately,” said CEO Daniel Eberhard, in a statement. “Canadians are paying some of the highest bank fees in the world while being sold products they don’t need or understand. We don’t think that’s right.”

Recent reports indicate that the practices of the Big Five Canadian banks are under review by the Financial Consumer Agency of Canada after receiving reports of aggressive and unethical sales tactics. Some of these allegations include selling products and services to consumers without expressed consent. The review of these practices will begin in April.

To begin signup process, interested individuals need only to download the app, sign up for the service and load the Koho Visa card with a balance through an Interac e-transfer, or by linking a personal bank account. Once this is completed, the Koho Visa card is then mailed to the user.

The process is entirely free, besides a few specific services like foreign currency interactions which cost extra money. In addition though, all the services provided through the app are free for users to access.

According to Eberhard, the response during beta testing was extremely encouraging, which aligns with the growing excitement about fintech technologies in Canada as of late.

“The response during the private beta was amazing. More than 10,000 Canadians signed up, we transacted over $1.3 million dollars. In virtually every metric, Koho is used in a fundamentally different way than traditional offerings. We’re growing really quickly,” said Daniel Eberhard.

According to data sent to MobileSyrup, users of the service use their Koho Visa card eight times per month, as compared to an average of one time per month for traditional banking apps. In addition, deposit amount grew by an average of nine times between the first and second deposits.

The federally regulated People’s Trust company issues the Koho Visa card to users and holds the money deposited on the card until users want to access it.

Currently, Koho is only available for download in the App Store.

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.