A new study out this week by Wall Communications has revealed that wireless prices rose between four and eight per cent in the past year in nearly every province, and in nearly every usage tier.

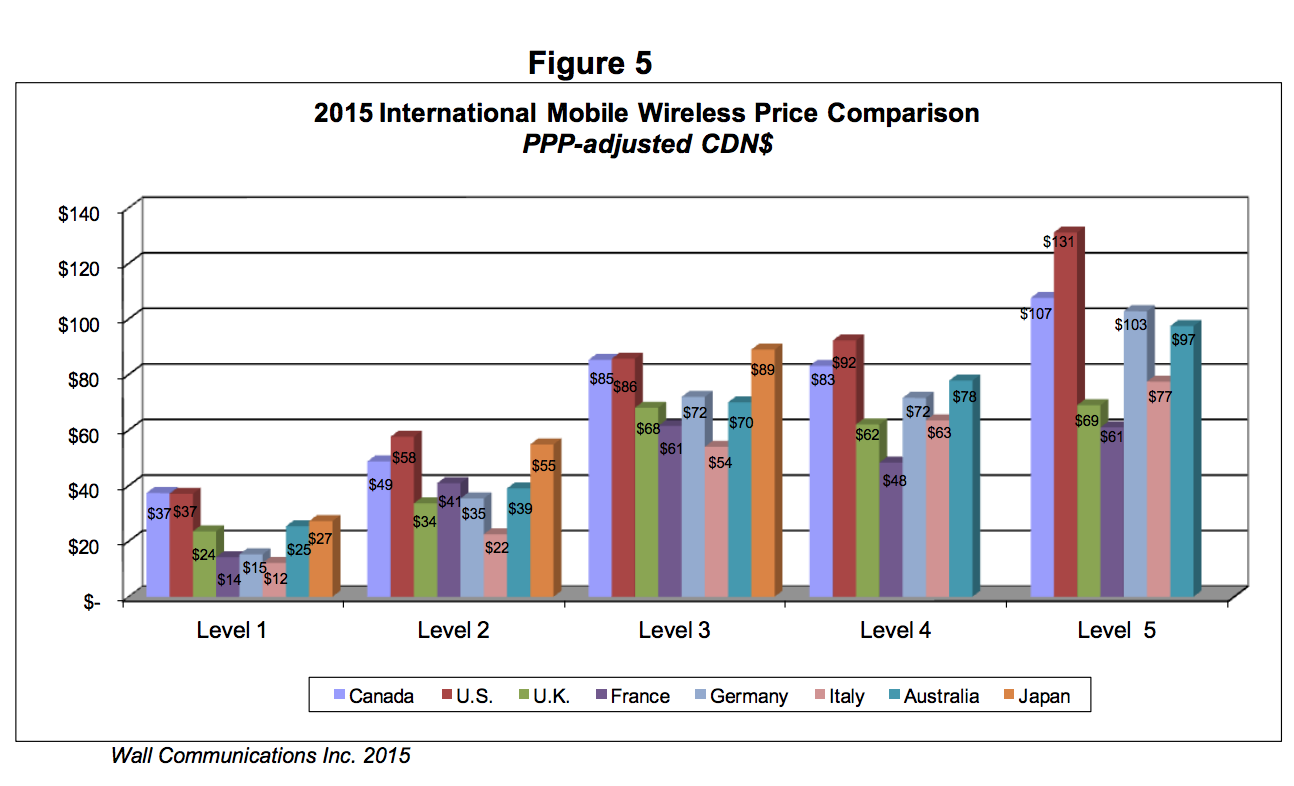

Wall Communications’ annual study looks at pricing trends in the Canadian telecommunications space and compares them with previous years, and with those of other developed countries. Once again, Canada ranked near the bottom of a list that included the U.S., the U.K., Germany, France, Italy, Japan and Australia, in some cases costing nearly double the equivalent plan in the most inexpensive countries.

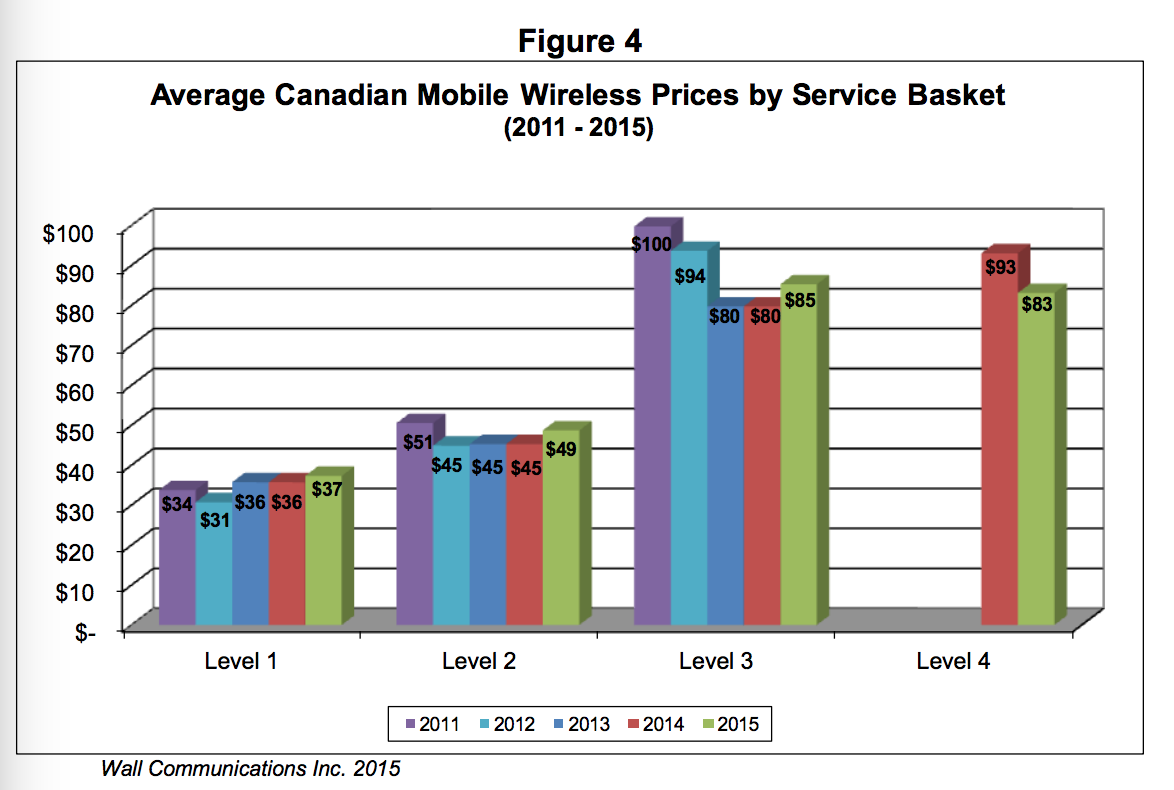

Canadians are also paying more in 2015 for the same plans as a year ago, with one major exception. The Wall Report looks at five tiers of service, from a plan with a small number of local calling minutes to one with unlimited nationwide calls, text and 5GB of data. Every tier but for the fourth, which includes unlimited calls, texts and 2GB of data, rose on average five per cent from the previous year.

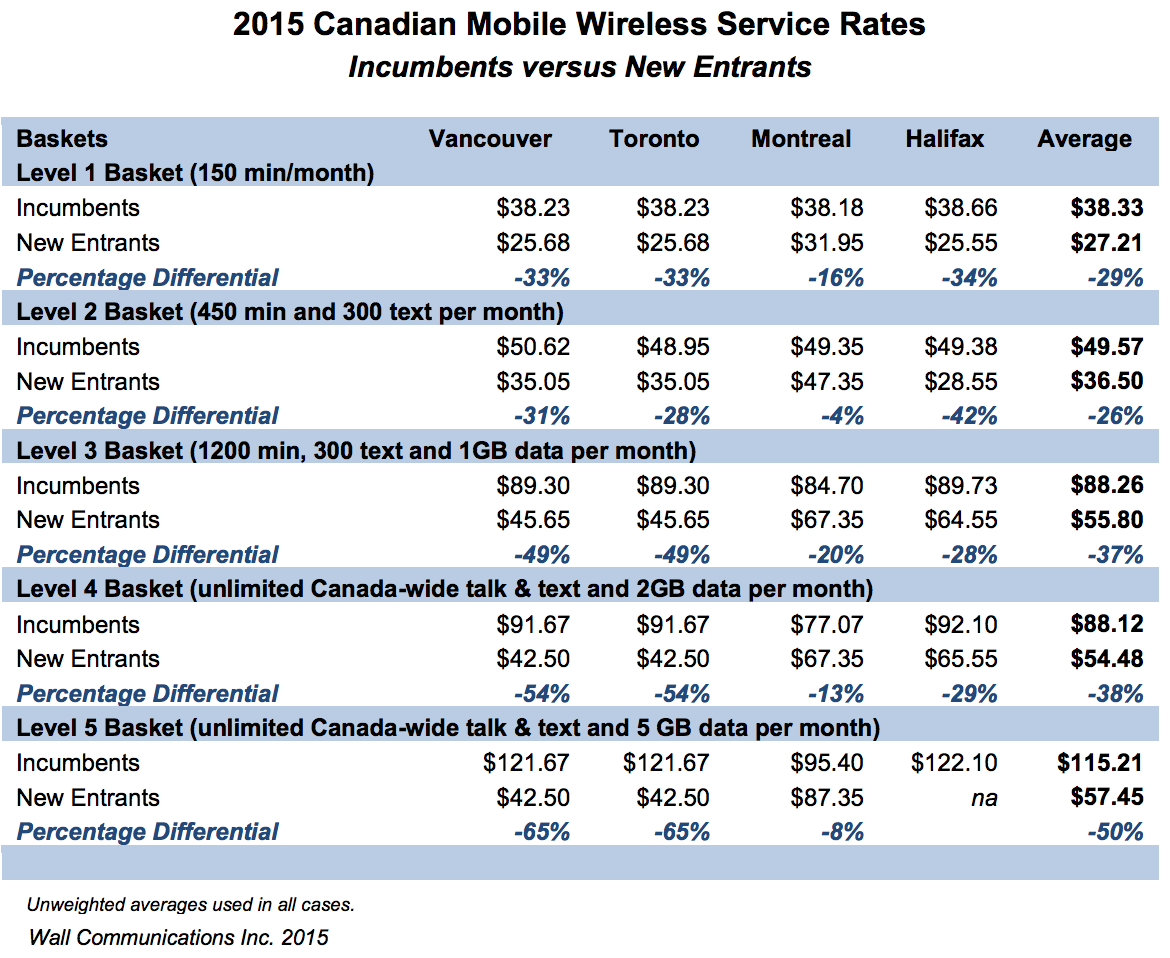

Regions with strong new entrants, like Montreal, or established regional incumbents, like Winnipeg or Regina, had the lowest prices across all five tiers, while Toronto, Vancouver and Halifax, areas with weakly penetrated new entrants, had the highest prices.

While the cost of wireless has trended downwards since 2008, and the price of 1200 minutes, some long distance minutes, 300 texts and 1GB of data has dropped 15% in the past four years, general talk and text plans have risen in price in the same period.

However, high data users paid 12 per cent less for a plan with unlimited calls, texts and 2GB of data in 2015 compared with the same period a year ago. The report also notes that so-called flanker brands, such as Fido, Virgin and Koodo, are between 10 and 23 per cent lower in cost than their incumbent equivalents, a fact that reinforces the new reality of value-added share plans, with built-in services like free mobile TV and streaming services, as differentiators. The report does note that Koodo, Fido and Virgin have all increased in price over the past year, removing much of the separation between them and their incumbent peers.

Finally, Wall notes that new entrants like Wind, Videotron and Eastlink cost between 25 and 50 per cent less than their incumbent equivalents in the same region, especially in the lower-priced tiers. And despite these new entrants undercutting the Big Three, in much of the country their presence is having little to no effect on price.

[source]Wall Communications (2)[/source]

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.