Canadian direct bank Tangerine launched new features on its iOS banking app, becoming the first bank in Canada to offer eye identification features for mobile banking, and among the first to offer vocal verification.

“Tangerine has always been the mobile and internet leader in the Canadian financial space and we’re ready to change the game for Canadians. We have taken our award-winning 4.5-star rated app and made it even better,” said Tangerine President and CEO Peter Aceto in a press release sent to MobileSyrup.

The app will now use Eyeprint ID by US-based EyeVerify to quickly and securely log customers in to its app by taking a picture of the user’s eyes. On its website, EyeVerify stated that its technology uses the “unique pattern of eye veins and other micro features around the eye” to identify individuals, transforming the Eyeprints in to an encrypted key.

For vocal verification Tangerine has partnered with Nuance, a US company focused on voice and natural language processing technology, to use its tool VocalPassword. The new feature identifies users by having them speak a passphrase which is compared with a stored version using biometric voice matching engines.

A subsidiary of ScotiaBank, Tangerine is a mobile and online-only bank with no brick-and-mortar locations, so advancements in remote identification were a logical next step for the institution. It’s not the only Canadian banking institution rolling out biometric verification, however.

Last month, the Bank of Montreal announced it was partnering with MasterCard on a pilot project for the first biometric corporate credit card program in Canada and the US called “Selfie Pay.” The feature requires the user to take a selfie to verify themselves using facial recognition. It will likely be available to all BMO customers by July.

In addition, the Royal Bank of Canada (RBC) and Manulife also work with Nuance. RBC rolled out its voice verification feature this past October, while Manulife adopted the technology in September.

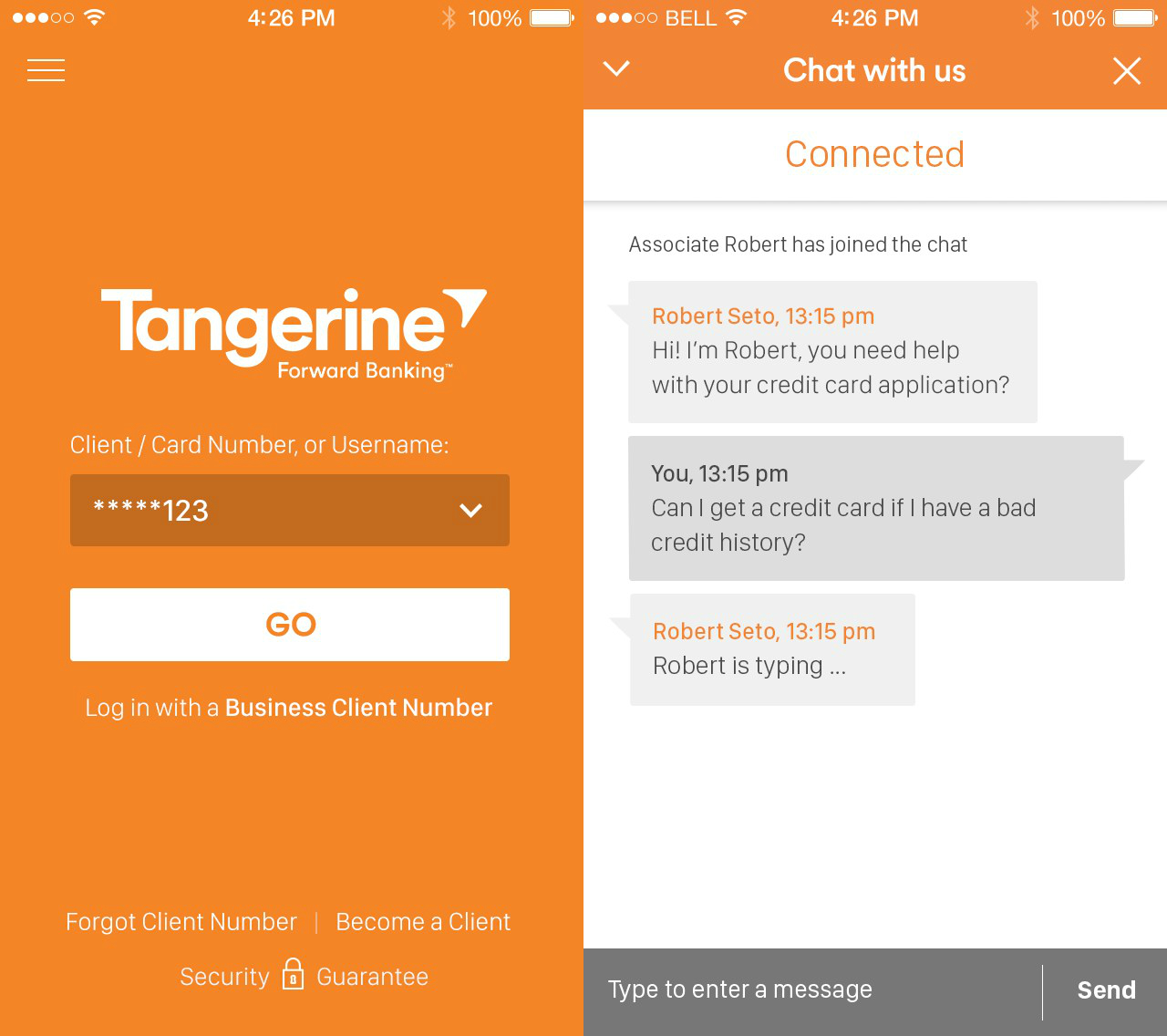

Along with biometric identification, Tangerine has also added a secure chat platform to its app that debuted on its website in January. The feature allows customers who have been identified and logged in to the app to get assistance from a live representative who can perform actions like changing an address or making a lump sum payment on a mortgage.

In the release Tangerine noted that it is using technology built by US customer experience and contact center technology company Genesys to power its secure chat feature.

Related reading: Face-on with MasterCard’s ‘Selfie Pay,’ now in pilot mode and set to launch this summer

[source]Tangerine[/source][via]Canada News Wire[/via]

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.