Toronto-based nanopay, a real-time payments platform, announced the launch of its self-service MintChip Retail Payment Platform.

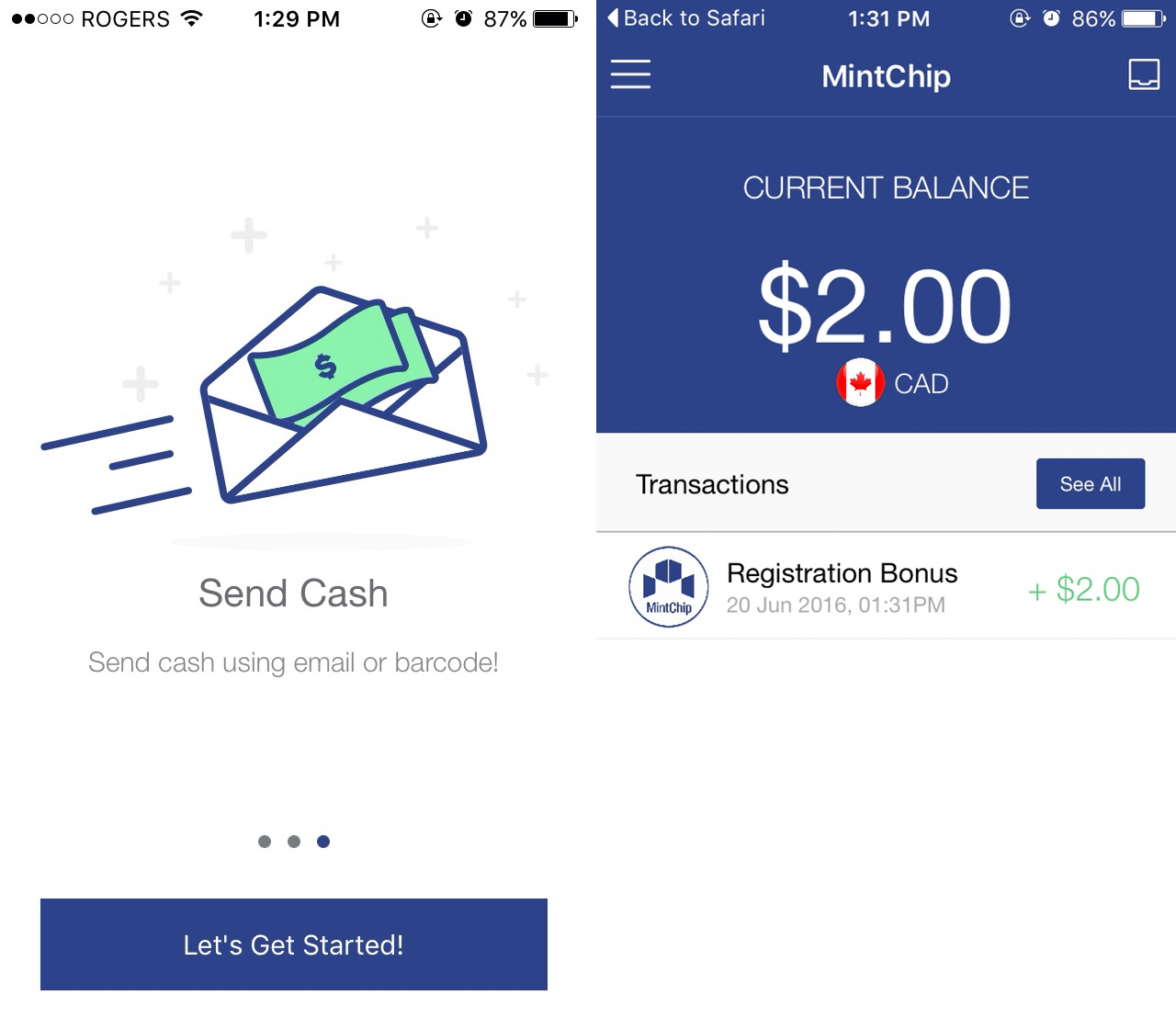

The MintChip Retail Payment Platform, which is available across Canada, includes both the MintChip Merchant app and the Mintchip mobile app for consumers. The platform allows merchants to accept digital cash in Canadian dollars, a capability that nanopay says delivers “all the benefits of traditional cash at a fraction of the cost of existing payment options.”

nanopay said that because it is creating a “digital representation” of the Canadian dollar, it can prevent counterfeit bills or charge-backs.

The platform is also available to global partners looking to create white-labeled retail closed loop payment systems. The system can be tied to the central bank currency of any country, or linked to a new or existing loyalty currency.

“Since acquiring MintChip from the Royal Canadian Mint, we have focused on enhancing the security, performance and scalability of our core nanopay platform,” said Laurence Cooke, CEO and founder of nanopay. “While today marks a milestone for the MintChip ecosystem in Canada, we are excited that partners can create custom retail payment systems that bring frictionless payments through digital cash to countries around the world.”

In addition to the MintChip retail payment platform, nanopay will offer a suite of services for cross-border payments to allow users to transfer funds in multiple currencies. The company also has a B2B payment network solution, which enables businesses to send payment requests to pay partners with transparency and context.

To target capital markets, nanopay’s technology integrates digital cash into bank’s back-end systems to reduce clearing and settlement costs.

nanoPay, which raised a $10 million Series A in October 2016, said through the MintChip payment platform, merchants will be able to use Ingenico payment terminals from Global Payments or as a standalone installation.

Merchants can also access a retail portal, which allows them to provide payment terminals, view transaction reports, and manage cash deposits to their bank accounts.

The launch of nanopay’s MintChip retail payment platform comes over a year after nanoPay acquired MintChip, a digital currency created by the Royal Canadian Mint.

nanopay isn’t the only Canadian company that is racing to dominate the merchant payments space. In April, Shopify announced a new self-designed chip and card reader, which allows customers to save their shopping and credit card information to reduce the amount of time it takes to purchase with Shopify Merchants.

This article was originally published on BetaKit

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.