Moneris, a Canadian credit card payment processor, has released its ‘Moneris Metrics report’ for the second quarter of 2017.

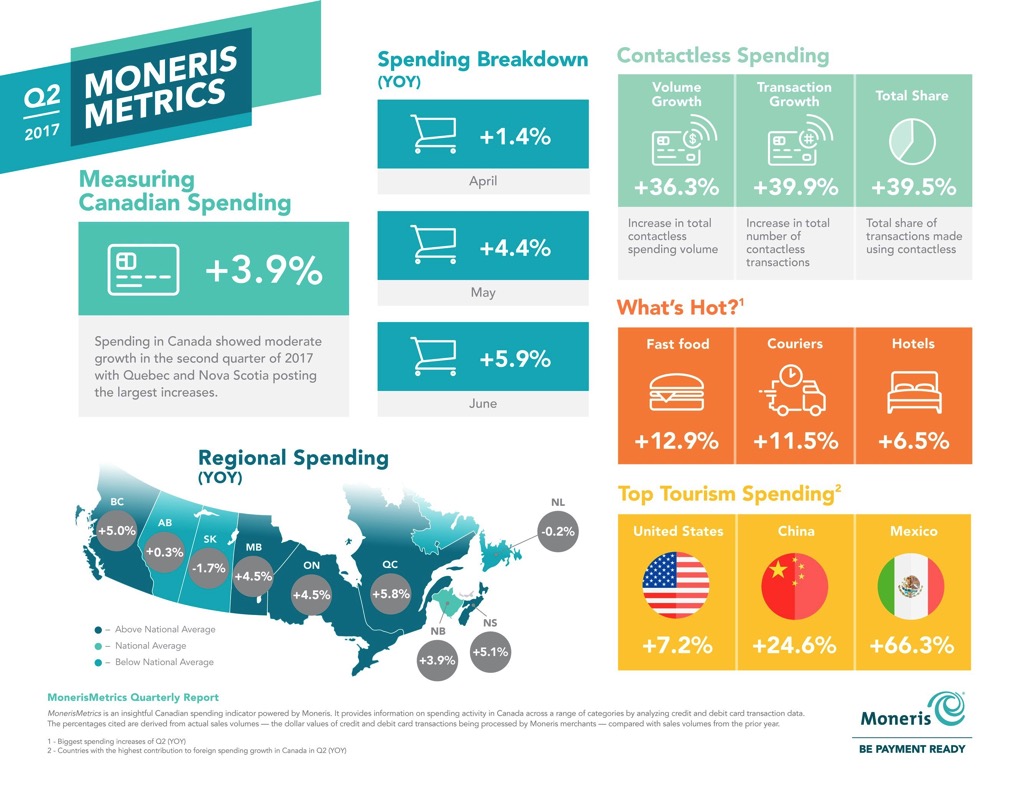

The report reveals that Canadians are spending more, with a 5 percent growth in British Columbia, 4.5 percent Manitoba and Ontario, 5.8 percent growth in Quebec and 5.1 percent growth Nova Scotia, with a national growth a 3.88 percent year-over-year.

While spending in Canada has raised, contactless payments have also increased in the country. Moneris unveiled a 36.29 percent year-over-year gain, possibly due to Android Pay recently launching in Canada, and with little more than a year since Apple Pay’s full Canadian release. Now that consumers have more practice with Apple Pay, Android Pay and other mobile wallets, it’s only natural to see a hike in usage.

Though 36 percent might seem like a large number, 2016’s Q2 report showcased a surge of 162.5 percent year-over-year, that Moneris suggests might show that contactless payment are progressing towards maturity.

However, when MobileSyrup asked Moneris about separating mobile wallets from contactless payments, the company did not reveal the data.

Within the next five and a half months Moneris predicts that 50 percent of all Canadian transactions will be contactless.

“With the introduction of more tap-and-pay options for consumers, and adoption numbers that show a slower, but sustained increase in use, it’s clear contactless payments have become a preferred method of payment for Canadians,” according Angela Brown, president and CEO Moneris, said in a statement.

“Businesses that have embraced this payment option are benefiting from the ability to serve a large group of consumers who enjoy the convenience and ease of contactless payments.”

Source: Moneris

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.