Toronto-based nanopay, a real-time payments platform for banks and businesses, said that it received “impressive scores” on the United States Federal Reserve’s Faster Payments Task Force Report, which provides recommendations about making payments faster and more accessible in the US.

Earlier this year, nanopay submitted a proposal for review to the United States Federal Reserve, which began a study on facilitating faster payments in the US three years ago. nanopay says the proposal, which listed recommendations that can help the Task Force assess, develop, and implement a faster and more secure payment system in the US by 2020, received “extremely impressive remarks,” and scored Effective or Very Effective on 33 out of the 36 evaluation criteria.

nanopay says it is one of the 16 proposers that met and exceeded the Task Force’s assessment criteria, which included identifying target use cases for faster payments; developing a range of possible design options to address speed requirements; assessing each design option for its effectiveness; exploring high-level business requirements; and providing a work plan for potential paths forward.

nanopay’s platform aims to deliver traditional cash at a lower cost of existing payment options. The company’s proposal presented different ways to deliver faster payments for B2B, P2P, B2P and P2B use cases, as well as proposed a clear and settlement payment system for banks.

“The current payments process in the US is slow, costly and provides very limited data on the purpose of the payment,” said Laurence Cooke, founder and CEO of nanopay. “A faster payment system is vital to maintain economic vitality and competitiveness, and it must continually evolve to meet the needs of a digitally interconnected, real-time and information-driven economy. The score our proposal received demonstrates that nanopay’s technology effectively addresses these pain points and provides secure, instant, low-cost and data-rich payments. We’re pleased to help the Task Force with this historic opportunity to develop a real-time payment system in the U.S. and see this as a catalyst to help other U.S. companies realize this vision as well.”

Based on its assessment of nanopay and other proposals, the Federal Reserve’s Task Force recommends establishing a formal governance framework to develop and support faster payments solutions, as well as address evolving security threats. The Task force is calling on payments stakeholders like nanopay to help make the country’s payments systems improve.

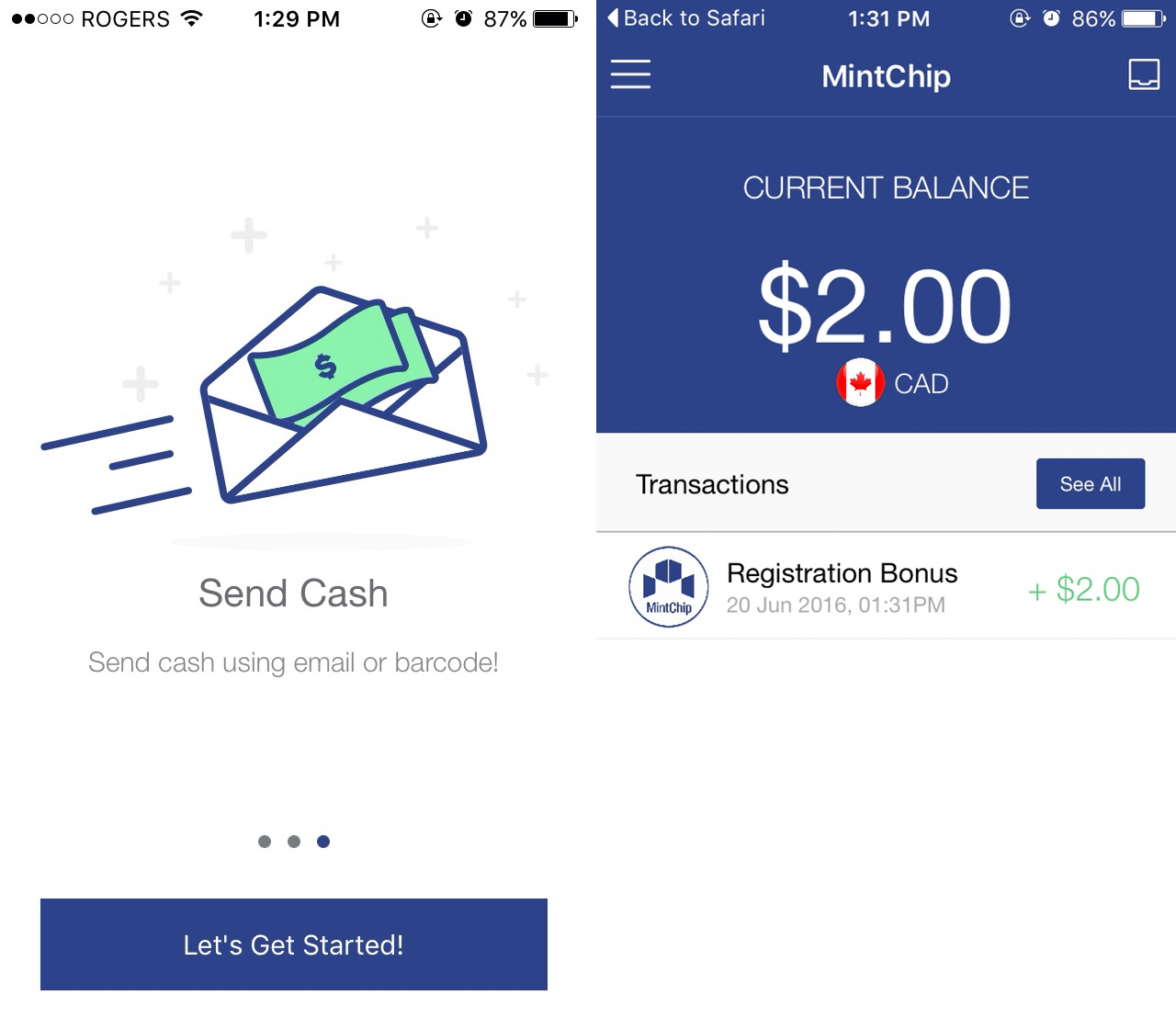

Last month, nanopay launched its MintChip retail payment platform just over a year after it acquired MintChip.

This story was originally published by BetaKit.

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.