Canadian Apple customers are going to start seeing GST/HST charges when making a purchase or rental on iTunes.

Marketing and public relations consultant Trevor Taylor tweeted in January 1st, 2019: “Did anyone else get taxed on their @AppleMusic subscription for the first time in Canada? Suddenly I’m being charged HST on the $9.99?”

Did anyone else get taxed on their @AppleMusic subscription for the first time in Canada? Suddenly I’m being charged HST on the $9.99? @iPhoneinCanada @MobileSyrup @Apple

— Trevor Taylor™ (@trevtaylor) January 1, 2019

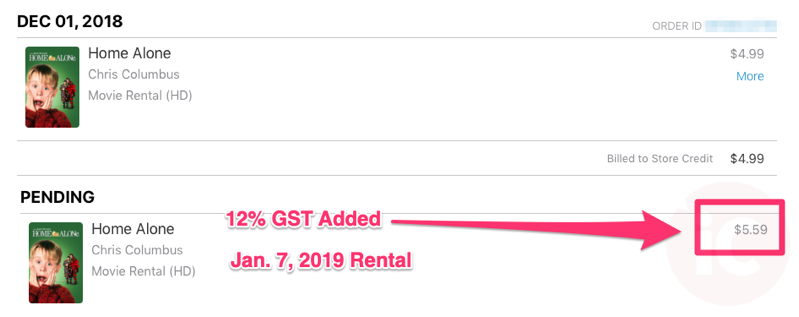

iPhone in Canada reported on January 7th that it too saw a new HST/GST charge when making a rental.

In a screenshot, it compared two different movie rentals made on different dates reflecting the changes. The first image showed a rental made before the New Year that charged the customer $4.99 CAD without the extra $5.59 (the customer was based in British Columbia where the sales tax is 12 percent).

Apple Canada confirmed to MobileSyrup that the changes will affect certain products.

“As the world’s largest taxpayer, we respect the important role taxes play in society. Due to recent changes in Canadian legislation and the growth of our business, sales tax will now be charged on purchases of TV, movies, music and audiobooks,” said a spokesperson for Apple.

The company said the changes were made after new Canadian legislation on digital sales tax went into effect on January 1st, 2019. That legislation is specific to Quebec.

That legislation was revealed in March 2018, when Quebec’s government revealed the digital sales tax plan that would require non-resident suppliers of digital services to register, collect, and remit a Quebec Sales Tax.

Non-resident digital businesses had to have registered before the start of the new year, the rule says.

That rule applies to the province of Quebec only. As far as the rest of Canada, there is no set in stone rule for taxing non-resident digital businesses.

In January 2017, the CBC reported that, according to an internal government document, the federal government was in talks of taxing foreign-supplied services like iTunes, Netflix and Spotify.

That document had suggested that not having these taxes “not only represents a significant loss of potential tax revenue for government, but it can also place domestic digital suppliers at an unfair competitive disadvantage.”

Federal Members of Parliament have debated whether foreign digital businesses should be subjected to a tax, but no legislation has gone into effect.

The decision to tax customers could mean that the company is pre-emptively making a move that could eventually affect all foreign digital businesses, while at the same time coincide that decision with Quebec’s newest legislation changes.

It’s also important to note that Apple has been in Canada for 38 years. The company already charges HST/GST for most of its other products and services.

Source: Twitter

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.