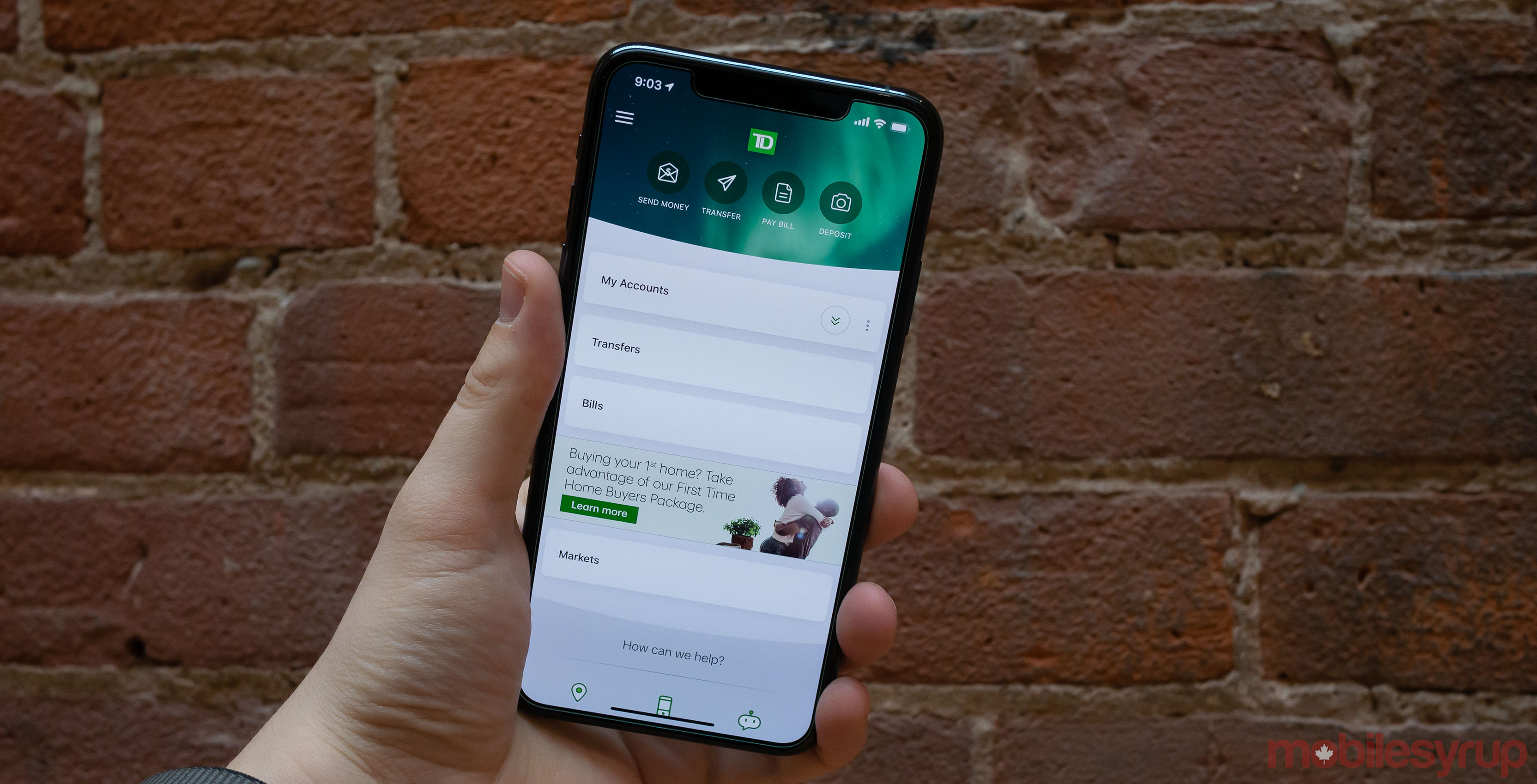

TD has announced that it will be using artificial intelligence to deliver more personalized advice and information to its customers through its app.

The feature is still in the test phase and will be updating the current app called MyTD. TD says it will leverage artificial intelligence to help customers make financial decisions.

MyTD will provide customers with proactive and personal information to better manage their finances. It will gather data about monthly spending patterns and account balances and then use machine learning to present the findings. TD says the goal is to provide personal insights that customers can take action on.

Taking a proactive approach

One of the features that is currently being tested is an AI-powered balance predictor tool that would notify customers when they have upcoming bills, and then offer proactive tailored advice.

“It uses intelligence to determine that the customer has an upcoming payment,” Imran Khan, the vice-president of digital customer experience at TD, told MobileSyrup.

Another part of the balance predictor tool is a feature that would notify users of an irregularity in their transactions. If they are spending a little bit more on something, like Uber, they have the option to track the transactions more closely.

Customers will be able to decide if they want to keep receiving more of these types of insights. TD will then be able to understand which kinds of insights customers prefer and actually want to track.

The app has always been used as a tool for transacting, but will soon be able to be used as a tool for engagement and provide direct utility to the customer, Khan said.

The new features will also aim to help customers navigate different situations, such as having a low balance for a particular month. Instead of leaving the customer to figure it out on their own, Khan says the new tool within MyTD will help with the management.

“We can help them through that journey. We can give them the right insights and intelligence,” said Khan.

TD and artificial intelligence

TD’s chief AI officer, Tomi Poutanen, says the bank is leveraging artificial intelligence in a number of different ways to improve customer experience. He also says that machine learning can be used to update current business models.

“When we bring machine learning to the equation, we can process more data and we can process a lot more features with a much broader look at the customer. We can then train a model that is more complex, but is more powerful than the older models,” said Poutanen.

Poutanen says that accuracy has vastly improved since the bank has applied machine learning and moved away from linear models. For instance, there was at least 30 percent more accuracy reported when the bank moved to machine learning models. An example of the different machine learning models is the balance predictor tool.

As for artificial intelligence and its use in TD, Khan says that the technology is amazing and that the capabilities with it are endless.

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.