TD Bank has announced a new personalized app experience aimed at serving the needs of an increasingly digital customer base.

The bank has set out to give users a more personalized experience tailored to their financial needs based on their past behaviour and transaction patterns.

Rizwan Khalfan, the chief digital and payments officer at TD, told MobileSyrup in an interview that TD has seen large amounts of digital adoption and engagement amid the COVID-19 pandemic and that it has had to respond to the growing needs of customers.

“We built self-serve capabilities in record time to serve customers, and we established an architecture where we could build upon the technology we already had,” Khalfan explained.

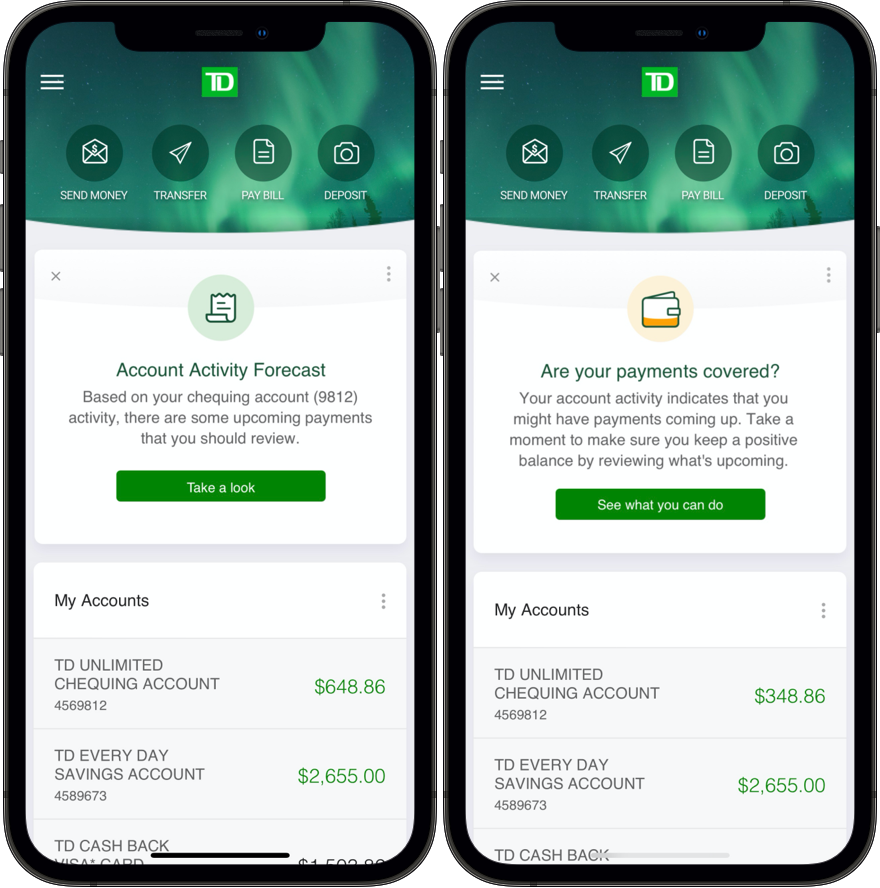

With a new low balance prediction feature, TD mobile app users will start to receive digital nudges powered by artificial intelligence that offer proactive insights for their specific accounts.

The app will use the predictive capabilities of AI to alert customers who are likely to encounter a low balance in the next two weeks with a digital nudge so that they can prioritize their spending. Customers will also be able to view and understand their recent spending once they are directed to the insights card.

“If your balance is going to be low, then we take you to a card which gives you insight on why the balance may be low and actions you can take. This way, you can get ahead of your financial matters,” Khalfan stated.

Further, Imran Khan, the head of the global digital experience at TD, explained during the interview that once users receive the digital nudge, they can provide feedback on whether they considered it helpful.

“The feedback is used in the system, and the algorithms will use that feedback to optimize the app. When we show that nudge, if the customer says it wasn’t helpful, then we can make sure to never show it to the customer again,” Khan stated.

Another new feature provides users with a list of upcoming bills within the next two weeks based on recurring transactions from the last two years. This is meant to help users who have been identified by the algorithm as having challenges with cash flow.

Customers are then given personalized options of moving money from account to account, and they can also view their schedule of upcoming payments to better plan for their financial needs and make necessary adjustments.

Khan explained that the digital nudges users see are relevant to their preferences and based on their data and that it has to be highly relevant to the user for it to be displayed at the top of the app.

These new features have rolled out to 50 percent of TD’s six million active mobile customers and are expected to roll out to the remaining 50 percent over the next few weeks, as Khalfan explained that TD rolls out new features in phases to manage the changes.

Upcoming features aimed at enhancing the app experience

The bank has outlined that it plans to continue to evolve its digital experience to build end-to-end engagement that supports all parts of a customer’s financial life. It notes that proactive digital nudges can help users identify steps they can take to manage their finances better.

“TD continuously goes down a path to understand customers, their preferences and their behaviours in a proactive manner to help them towards financial wellness,” Khalfan stated.

He noted that in terms of the future, the bank will find ways to determine where AI can play different roles. In some cases, AI will provide predictive insights, and in other cases, it can drive automation of tasks and increase efficiency.

Starting in 2021, TD plans to use AI-powered digital nudges to offer customers insights into how they can save and invest to prepare for their retirement. To achieve this, the app will connect users to resources that can help them reach their financial goals.

Another upcoming feature will predict users’ needs for support when they sign up for a new direct investing account. They will be given a tailored onboarding experience that will lead to insight cards that offer guidance to help build customer confidence when trading.

Customers may also receive an AI-powered nudge about the new TD Global Transfer Marketplace, where they can learn more about new transfer options and how they can save on international transfers.

Khan outlined that TD interacts with customers regularly and has found that customers are becoming more comfortable with data when it’s being used to support their needs.

Image credit: TD Bank

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.