The federal government has released its latest quarterly wireless price reduction report claiming there’s “progress on reducing prices.”

Not that it matters.

Here’s the thing — the report shows pricing data for July, August and September 2021, but carriers actually started implementing plans that meet the targets in October (and thus, those plans aren’t in this report).

I’d argue the other value of these quarterly reports would be a historical record of wireless plan prices. Unfortunately, the report fails there too since almost every section is marked with a tilde (~) — as the legend notes, that indicates a carrier didn’t advertise that data plan on their website at the time of sampling. The report also fails to document plans that fall outside of the specific data buckets the government chose to target.

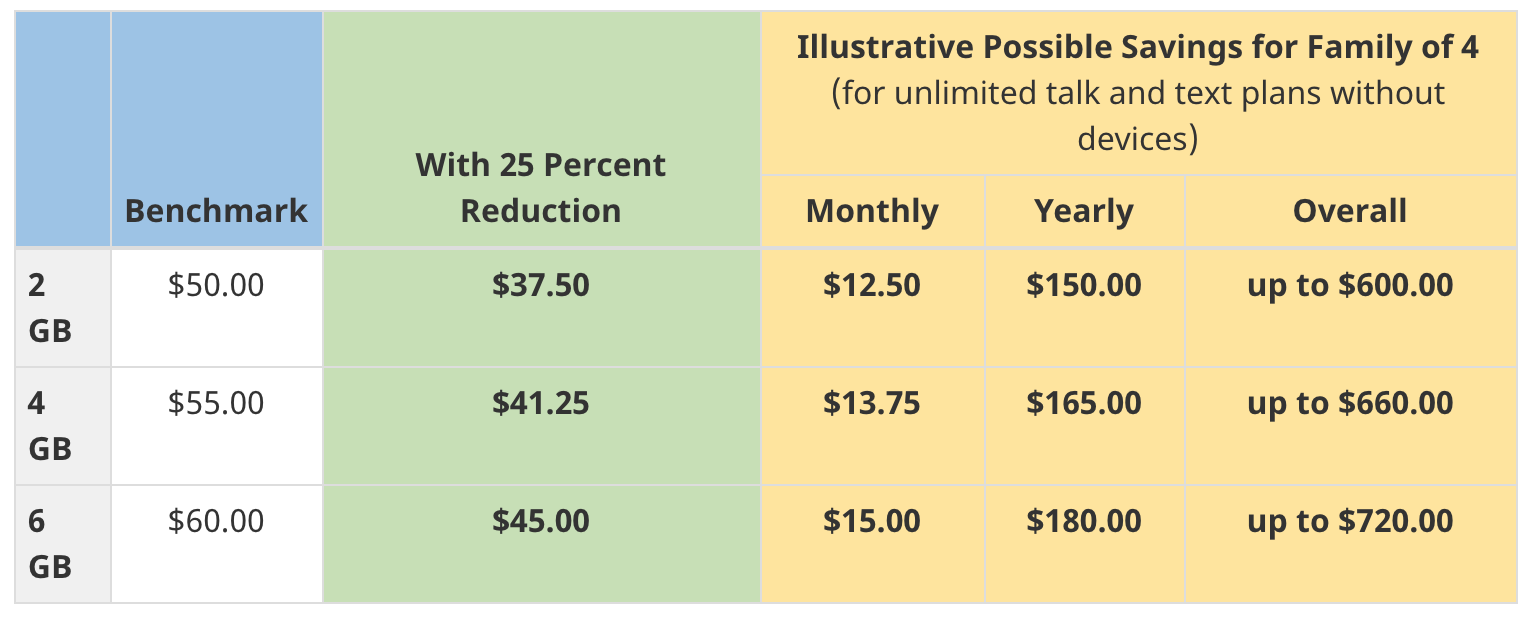

As a reminder, the government’s goal was to see a 25 percent reduction in price based on benchmarks set in 2020. Those benchmarks would see a $50/mo plan with 2GB of data drop to $37.50/mo, a $55/4GB plan drop to $41.25/mo and a $60/6GB plan drop to $45/mo.

“Progress” is when no carriers meet your targets

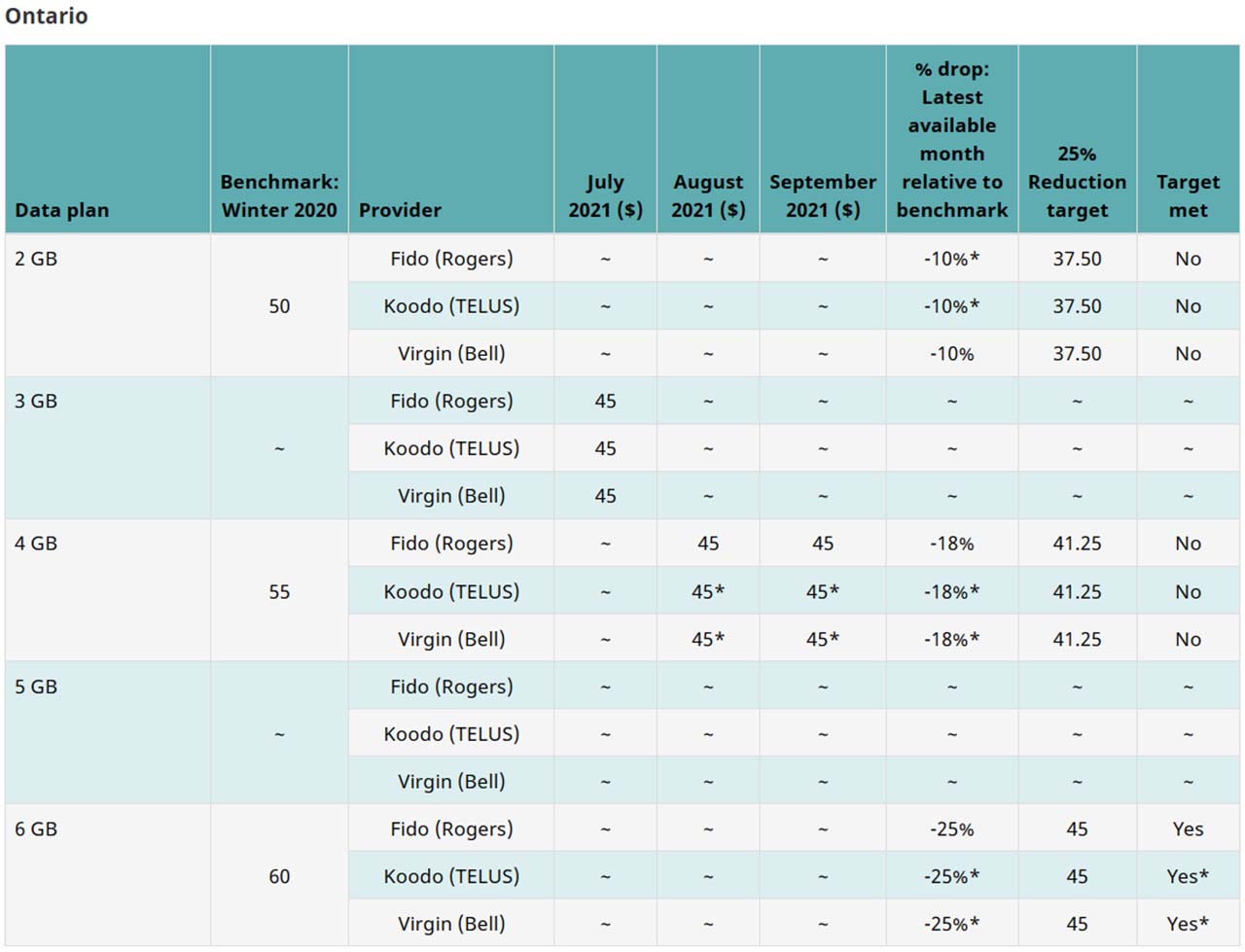

With the exception of Quebec, every province has an almost identical chart (I’ve included the Ontario one below for reference).

A few important things to note about the chart. First, it doesn’t show anything outside of the listed data amounts. That means that arguably decently priced plans, such as the $50/10GB plans offered by Koodo, Virgin Plus and Fido in August, aren’t included. Second, the chart only shows pricing from Koodo, Virgin Plus and Fido, which are flanker brands of Telus, Bell and Rogers respectively. That has allowed the big three carriers to effectively offload the 25 percent price reduction requirement on the flanker brands while continuing to charge high prices (plans start at $80/mo at all three).

Third, the chart claims that the $45/6GB target was met despite none of the sampled carriers offering a $45/6GB plan during the quarter. Fido was the only carrier to previously meet that requirement and it only did so in June 2021. Really, the Rogers flanker brand should be the only carrier marked as meeting the $45/6GB target, and even then I’d argue it shouldn’t get the privilege since it removed the plan. What’s the point if carriers only have to meet the 25 percent price reduction target one time, and can then go back to charging high prices?

Again, none of this really matters that much given that Koodo, Virgin and Fido have since introduced plans that meet (or at least come close to meeting) price reduction targets. The three flanker brands have a $38/2GB plan (Virgin’s is actually the required $37.50 price), a $41/4GB plan (again, Virgin matches the price exactly with a $41.25/mo plan) and a $45/6GB plan. However, this change won’t be reflected by the government’s reports until it releases the next quarterly report.

Although the flanker brands have technically met those targets, all have done so resentfully by restricting these plans so that anyone who wants to get a new phone with one of these carriers cannot also get one of these lower-cost plans.

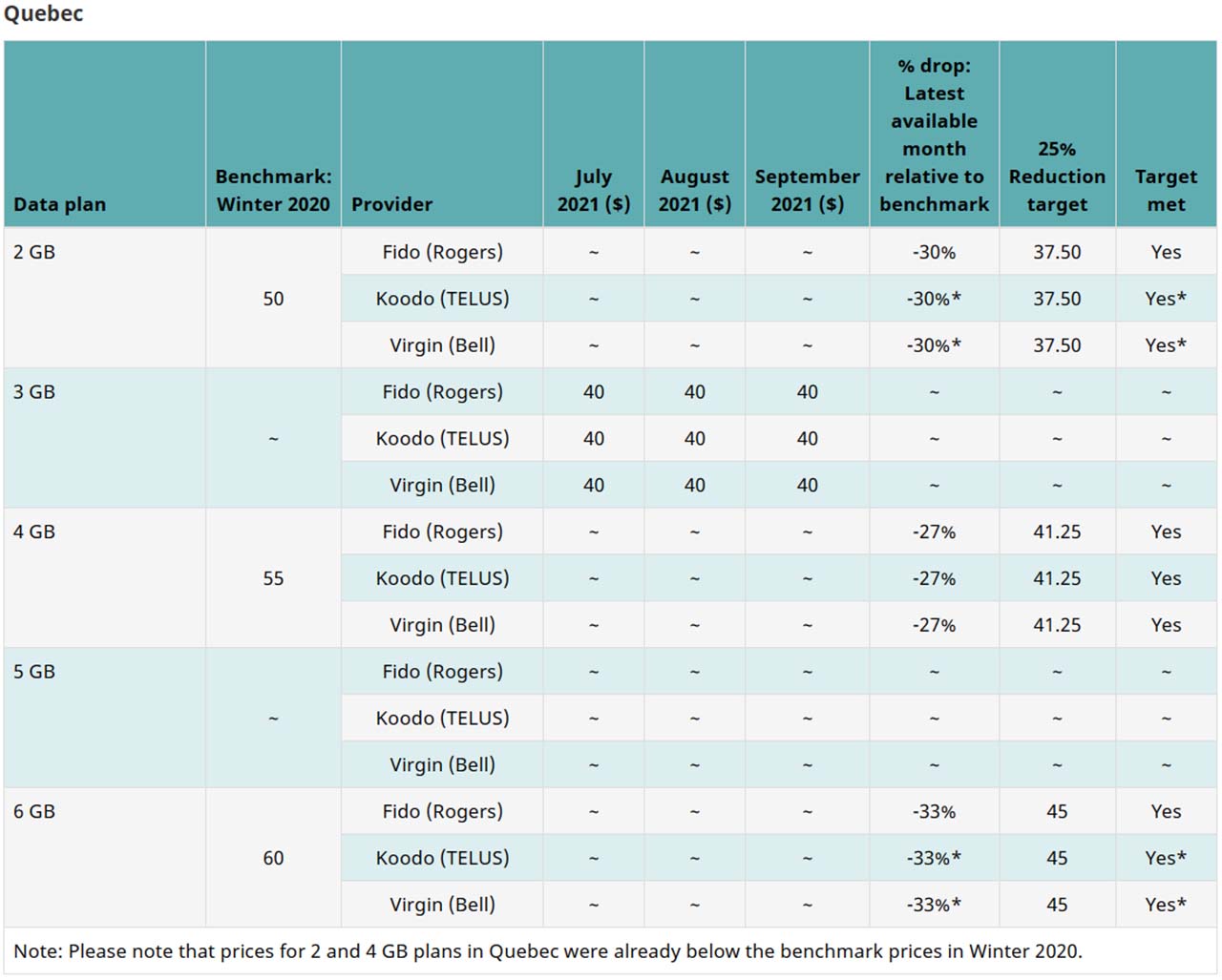

Quebec has the only different chart, but it’s not really that different

As for Quebec, the most recent quarterly chart shows that Koodo, Virgin and Fido don’t offer any plans in any of the target data buckets. Again, the chart lists all the price reduction targets as being met despite that none of the carriers have offered plans that meet or beat the price goal since June 2021.

Finally, as I pointed out with the last quarterly report, the government’s charts don’t incorporate other costs involved with carriers, some of which can discourage customers from switching. One excellent example is the connection fee (which leapt to $50 earlier this year at most major carriers). There are often ways to waive the fee, but that doesn’t stop it from acting as a deterrent for switching.

Ultimately, this latest quarterly report is another example that the Canadian government has failed to address wireless pricing. Sample carriers do not consistently meet the price reduction targets, and when they do, it’s through promotions or heavily restricted plans designed to deter customers. Prices have gotten better, but it’s hardly enough. Worse, the government has so far refused to implement changes that would help the situation. For example, mandating MVNO access, something favoured by Canadians and independent players and fought vehemently by the Big Three and other larger regional telecom companies.

You can view the previous reports at the links below:

- Government wireless pricing update shows decreasing costs, inconsistent availability

- Government releases latest tracker for 25 percent wireless price reduction goal

- Government releases second report tracking 25 percent wireless plan reduction commitment

- Government releases first report tracking 25 percent wireless plan reduction commitment

MobileSyrup may earn a commission from purchases made via our links, which helps fund the journalism we provide free on our website. These links do not influence our editorial content. Support us here.